The exercises from Chapter IX on risk considerations are:

- Explore a few different news sites for business and economic news, and check out Rover’s Weekly Market Brief for a summary of the week’s economic events. What do you learn that could be applicable to your investing?

- Chart all sectors against the S&P 500 over different time periods. Which sectors are performing the best?

- How do you feel about the sector and industry that your stock is in? Does it seem like a good place to be, or are there strong headwinds?

- Consider the red flags covered in this chapter. Does your stock match any of them? If so, does this lead you to any new concerns about the company? Or does it cause you to feel more positively about it? Why?

Here is where you can get the relevant information in Stock Rover.

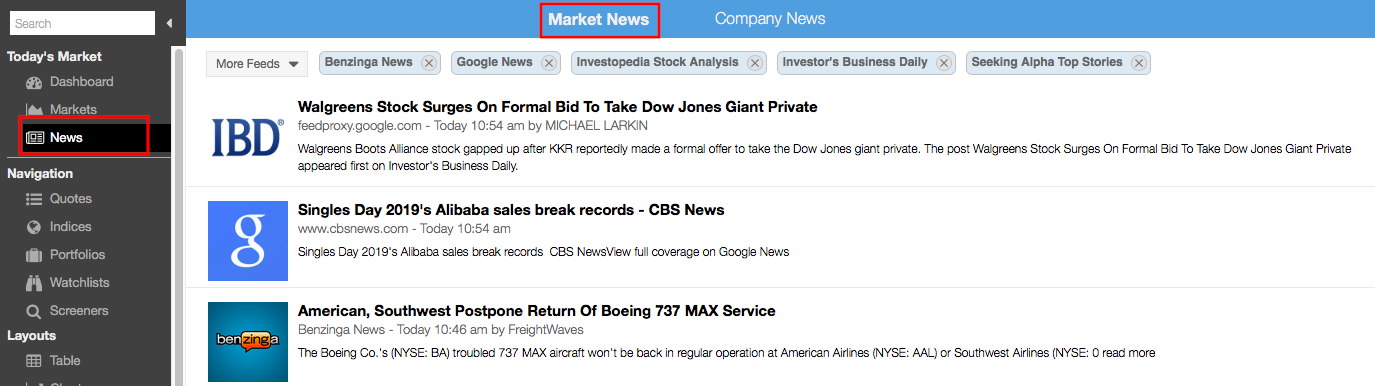

Market News on Stock Rover

Market news can be found in the Stock Rover universe at:

You can also select News then select ‘Market News’ see below:

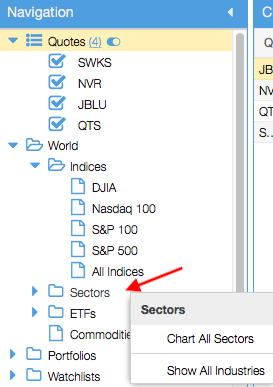

Chart All Sectors vs. S&P 500

The easiest way to do this is to find Sectors in the Navigation panel, right-click it, and select “Chart All” as shown below. Make sure the Chart is clear before doing this.

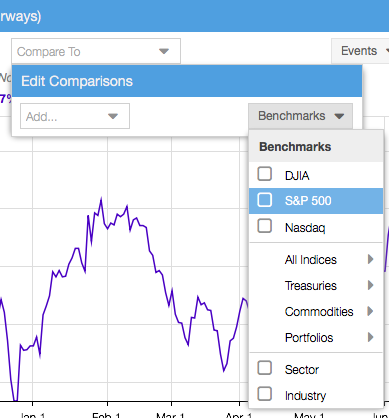

Then, add the S&P 500 from the Benchmarks menu, shown in the following image.

You can then set it as a baseline for the clearest picture of relative performance.

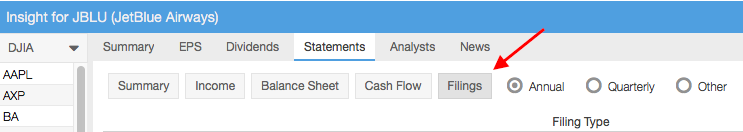

Learn about a Company’s Product Markets

This is qualitative data that you might have already become familiar with in the course of learning about your stock. You can find it from different sources, such as the company’s investor relations page, earnings call transcripts, and SEC filings. You can link to all that information from the Insight panel, Summary tab or Statements tab, as shown here:

For more information on using Stock Rover, see our Help pages or email our Support Team.