Income statements show revenue and expenses, but they do not necessarily show the amount of cash that a company receives or spends. For example, some revenue may come from credit sales, which means a company cannot really use that revenue to pay expenses until the customer pays their bill and cash has been collected. There can also be non-cash expenses that are accounted for during each time period that an income statement covers. Depreciation is an example of this type of expense.

Unlike the income statement, which includes non-cash income and expenses, the cash flow statement only shows the actual amount of cash that was exchanged between a company and the outside world over a period of time. Like the income statement, the cash flow statement covers a specific accounting period, but it focuses only on the the movement of cash in and out of the business during that period.

Because of this, the cash flow statement gives a sense of a business’s liquidity: its ability to pay dividends, make investments, pay off debt, or absorb unplanned financial burdens. Just like a person can be asset-rich (e.g., own a big house), but cash-poor (e.g., unemployed), the same is true for a company.

When investing, you want to make sure a company’s actual cash inflows are keeping up or exceeding its outflows. Cash flow trends can verify trends in reported earnings. While earnings can sometimes be distorted by accounting gimmicks, it is not so easy to do that with cash flow.

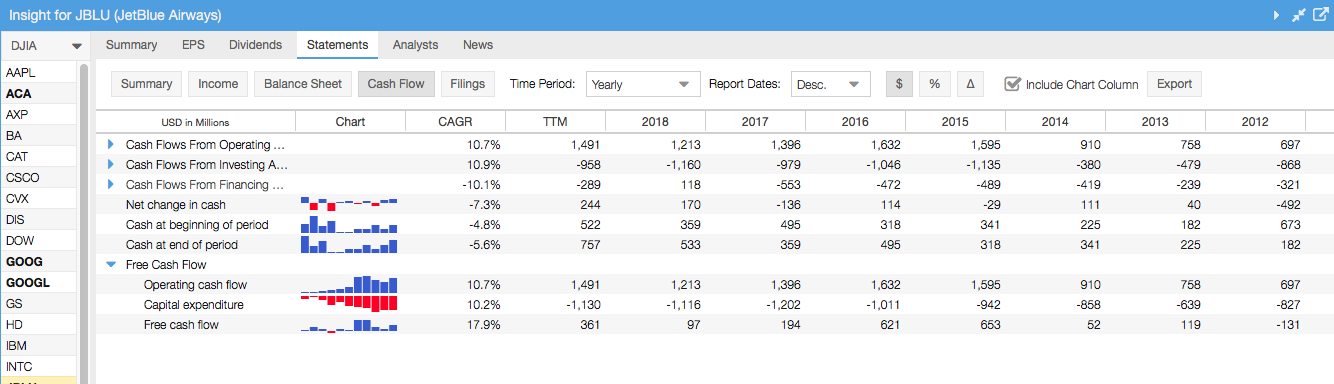

Below is an example of information from yearly cash flow statements that you can find in Stock Rover.

As you can see in the image above, cash flows fall into one of three categories: operating, investing, and financing.

- Operating activities include the cash from the day-to-day operations of the company. This section shows you how much of the earnings shown on the income statement were actually cash the company ended up with to use to grow the business and reward stockholders..

- Cash flows from investing activities come from purchases and sales of long-term assets and investment securities. If a company decides to sell off some investments from its portfolio, or make capital investments, the proceeds from the sales or cost of the investments show up as cash flows from investing activities.

- Financing activities include issuing or repurchasing company stock, issuing bonds, borrowing from banks, or paying dividends.

Cash flows in any of these three categories, especially the latter two, can change significantly from one quarter to the next based on non-repeating or non-regular events, such as the purchase of new equipment. Therefore, it is best to check the net change in cash line to see that, on the whole, cash is increasing or staying constant..

Free cash flow (FCF) is a metric that is calculated from the cash flow information. It gives you a more conservative assessment of liquidity. To calculate it you subtract capital expenditures (capex) from operating cash flow.

Positive FCF indicates that, after subtracting money needed to maintain or expand capital assets, there is still cash leftover. If this is the case, the company will have cash it can use to grow and expand and possibly even provide you, the investor, with a dividend. Negative FCF is not necessarily a bad thing—it might indicate a large capital expense that will ultimately serve the business in the long run. However, a history of negative FCF or a trend of decreasing FCF could be cause for concern, as it is difficult to run a business without a certain level of liquidity.

Another thing to compare free cash flow to is the rate of sales growth. It is a positive sign if a company is growing free cash flow at a similar or faster rate than sales. This means that revenue is increasingly translated into cash so that more earnings are freed up for growing the business or rewarding shareholders in the form of dividends. You can determine the trend of this ratio by comparing revenue in the income statement and FCF in the cash flow statement. Or use the Stock Rover table column FCF as a % of Sales and see how it has changed over time.

A list of additional cash flow metrics can be found here.

Now you know the basics of the three major documents that not only describe a company’s financial health, but also show you how well it is operating its business. They provide data used in countless financial calculations and metrics that can help you determine whether or not you want to purchase shares in a company.

In the next chapter, we’ll look at some of the metrics derived from financial statements that can help you understand the profitability and efficiency of a business.

Exercises:

Practice using cash flow metrics with the following exercises. See this page for assistance.

- Find the cash flow statement for the company you are interested in.

- Is the company cash positive overall? Which activities are cash flow positive (add to cash flow), and which are cash flow negative (subtract from cash flow)?

- How has free cash flow (FCF) changed over time? Is it usually negative or positive? If FCF is negative but cash flow is positive, what does that tell you?

- Find the FCF as a % of sales metric and see how it has changed over time. Is cash growing more or less rapidly than sales? What does that tell you?

- Do the trends you see in the cash flow information let you know this is a strong, thriving company or do they tend to make you realize the company might be weaker than its earnings trends might indicate?

Next: Profitability

This guide was created in partnership with bivio, which provides online investment club accounting and hedge fund management services.