Contents

- Introduction [1]

- The Screeners [2]

- The Portfolios [3]

- Historical Portfolios [4]

- Conclusion [5]

Introduction

We have created an updated set of portfolios that are based on some of Stock Rover’s most popular screeners. You can import any of the portfolios that interest you into your Stock Rover account via the Stock Rover Investors Library [6]. This will allow you to see each of the stocks that passed the associated screener and track their performance.

The portfolios can be used to test performance as we go forward in time. This in turn can give us an idea of which screeners are performing well in the current market environment and which ones are performing poorly.

The Screeners

The methodology I used was to run 16 separate popular Stock Rover screeners on December 30th, 2025. Each screener generated its own unique list of passing tickers. The passing tickers were in turn used to generate 16 separate portfolios, each based on a specific screener.

Each portfolio had a differing number of stocks, based on the number of stocks that passed the screener. However, all portfolios were constructed so each passing stock was equally weighted within the portfolio, with each stock getting an allocation of $100,000 of virtual capital within the portfolio.

The 16 screeners that were tested were as follows:

- Breakout Screener

- Buffettology Inspired

- CAN SLIM

- Capital Efficiency

- Dividend Growth

- Fair Value

- Growth at a Reasonable Price

- Large Cap Growth with Momentum

- Large Cap Value

- Long Term Growth

- Piotroski High F-Score

- Relative Strength

- Safe Performers

- Small Cap Growth

- Strong Buys

- Top Stocks

All of these screeners are provided by default when you first create your Stock Rover account. If you have been a Stock Rover member for a long time, the screeners in your account may not match this list, but all of the above screeners are available from the Library and any of them can be imported [7] into your account.

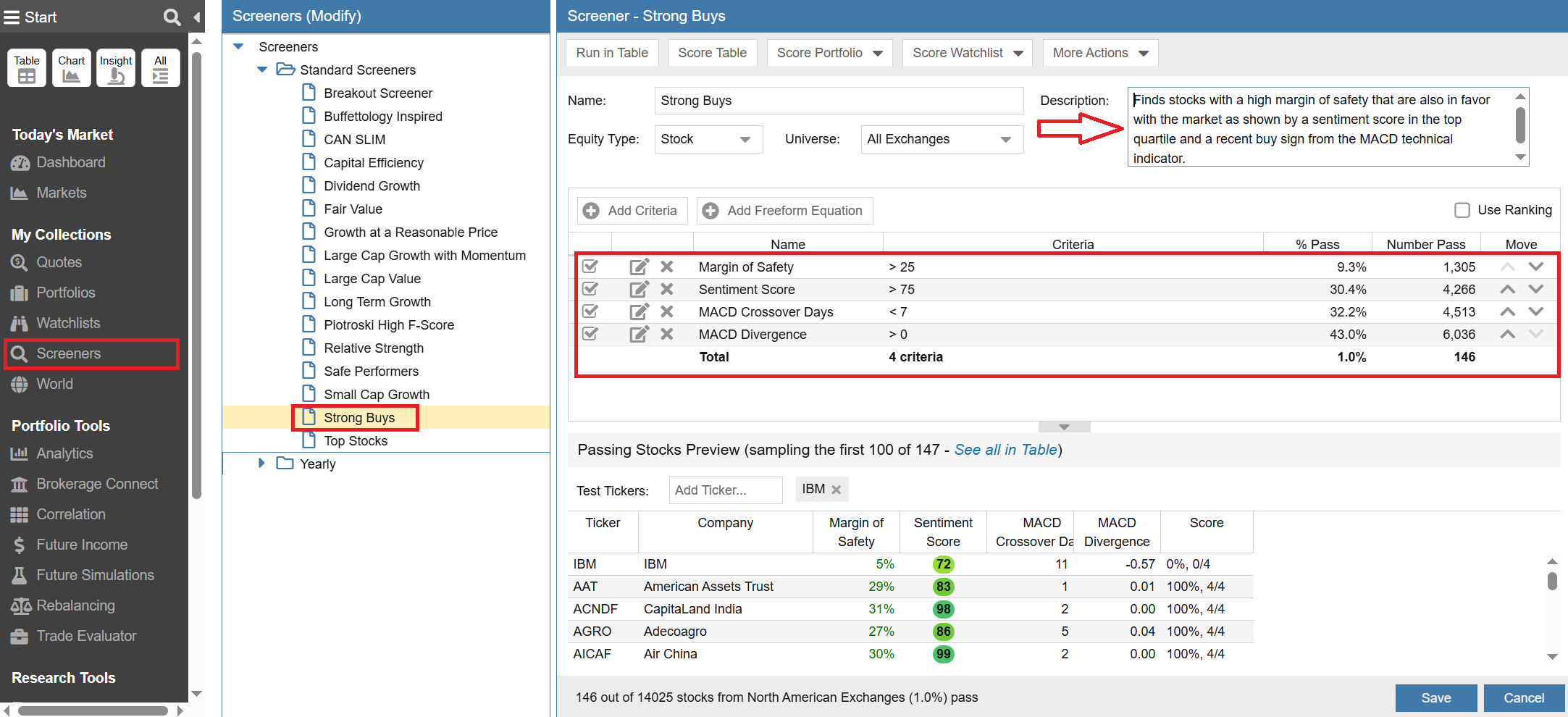

By using the Stock Rover Screener Manager [8], the detailed descriptions for the screeners can be found in the description within the screener itself. And the screener criteria can be viewed from within the Screener Manager when the screener is selected.

An example using the Strong Buys screener is shown below.

The Portfolios

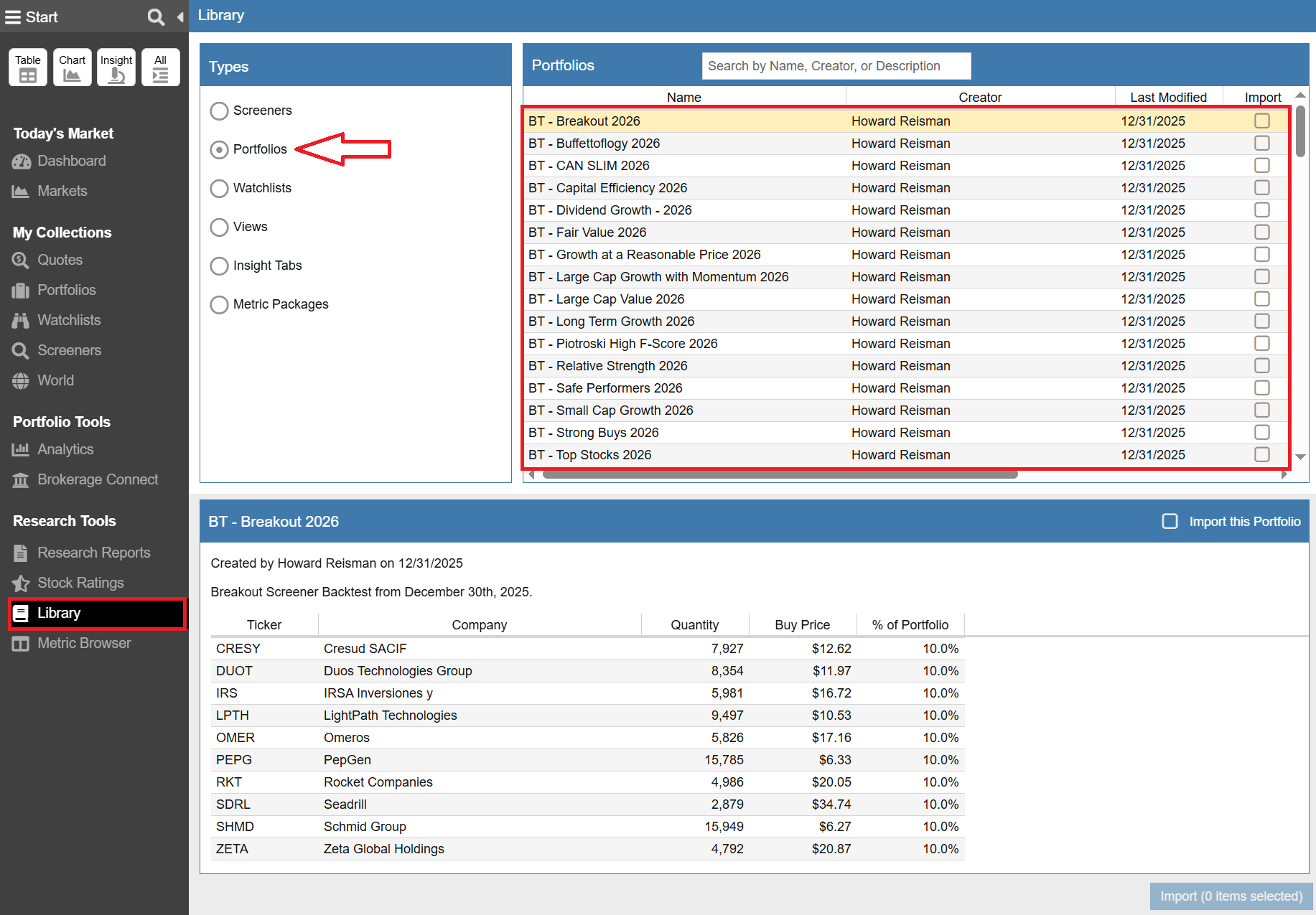

Each of the 16 portfolios created from the screeners is named in a consistent fashion in the format BT – screener name 2026, where screener name is the name of the associated screener. BT is an abbreviation for Back Test.

For example the portfolio associated with the Dividend Growth screener is named

BT – Dividend Growth 2026.

All of the portfolios created for the backtest exercise are available for import from the Stock Rover Library.

The following table lists the number of stocks that passed each of the 16 screeners when they were run.

| Portfolio | Number of Positions |

|---|---|

| BT – Breakout 2026 | 10 |

| BT – Buffettology 2026 | 50 |

| BT – CAN SLIM 2024 | 4 |

| BT – Capital Efficiency 2026 | 48 |

| BT – Dividend Growth 2026 | 95 |

| BT – Fair Value 2026 | 49 |

| BT – Growth at a Reasonable Price 2026 | 64 |

| BT – Large Cap Growth with Momentum 2026 | 28 |

| BT – Large Cap Value 2026 | 17 |

| BT – Long Term Growth 2026 | 50 |

| BT – Piotroski High F-Score 2026 | 55 |

| BT – Relative Strength 2026 | 137 |

| BT – Safe Performers 2026 | 21 |

| BT – Small Cap Growth 2026 | 9 |

| BT – Strong Buys 2026 | 133 |

| BT – Top Stocks 2026 | 32 |

You will notice that the number of stocks in a given portfolio vary from 4 (CAN SLIM Screener) to 137 (Relative Strength Screener). This dispersion can dramatically impact both the performance and the risk reward profile of a screener. Generally the more stocks in a portfolio, the smaller the performance variation and the lower the volatility. Or in other words, portfolios with fewer stocks will inherently have a higher risk/reward profile.

Historical Portfolios

Note all of the above portfolios have historical counterparts that are also available in the library. They have the same name as the above portfolios, but end with the earlier date period they cover, for example, BT – Top Stocks 2025.

Importing the older version of each portfolio, and then seeing how the portfolio performed since its inception can give you a good idea on the performance of the associated investment strategy over time.

Conclusion

The new portfolios that have been added to the Stock Rover Investors Library can give you a great head start to find some interesting investment candidates in 2026, as each of the portfolios is based on a popular screener in Stock Rover.

The new portfolio can also indicate which screeners are performing well in the current market environment and which screeners are not.

2 Comments To "New Portfolios – January 2026"

#1 Comment By George Ronald Gurne On February 1, 2026 @ 4:08 pm

How do I increase the picture size in Stock Rover?

#2 Comment By Ken Leoni On February 2, 2026 @ 2:32 pm

Hi,

There are a couple of options you can try:

If you’re using a desktop with multiple displays, you can expand to a separate browser window. This lets you take better advantage of your available screen real estate. For details, see:

[11]

[12]

You can also use your browser’s built-in zoom controls. For example, in Chrome:

[13]

Regards,

Ken