Imagine your portfolio is up 10% this year. You might feel great about that return. But what if the S&P 500 is up 20%? Suddenly, that 10% gain doesn’t look like a victory—it looks like a missed opportunity.

Most brokerage accounts only tell you what happened. To invest like a pro, you need to understand why it happened. You need to distinguish between luck (riding a bull market) and skill (generating superior, risk-adjusted returns).

In Part 1 [1], we established the baseline: tracking your positions and daily changes. Now, we move from observation to analysis.

In Part 2 of the Stock Rover Portfolio Guide, we dive into the analytics tools that separate casual tracking from professional-grade analysis.

Contents

1. The Big Picture: Portfolio Analytics

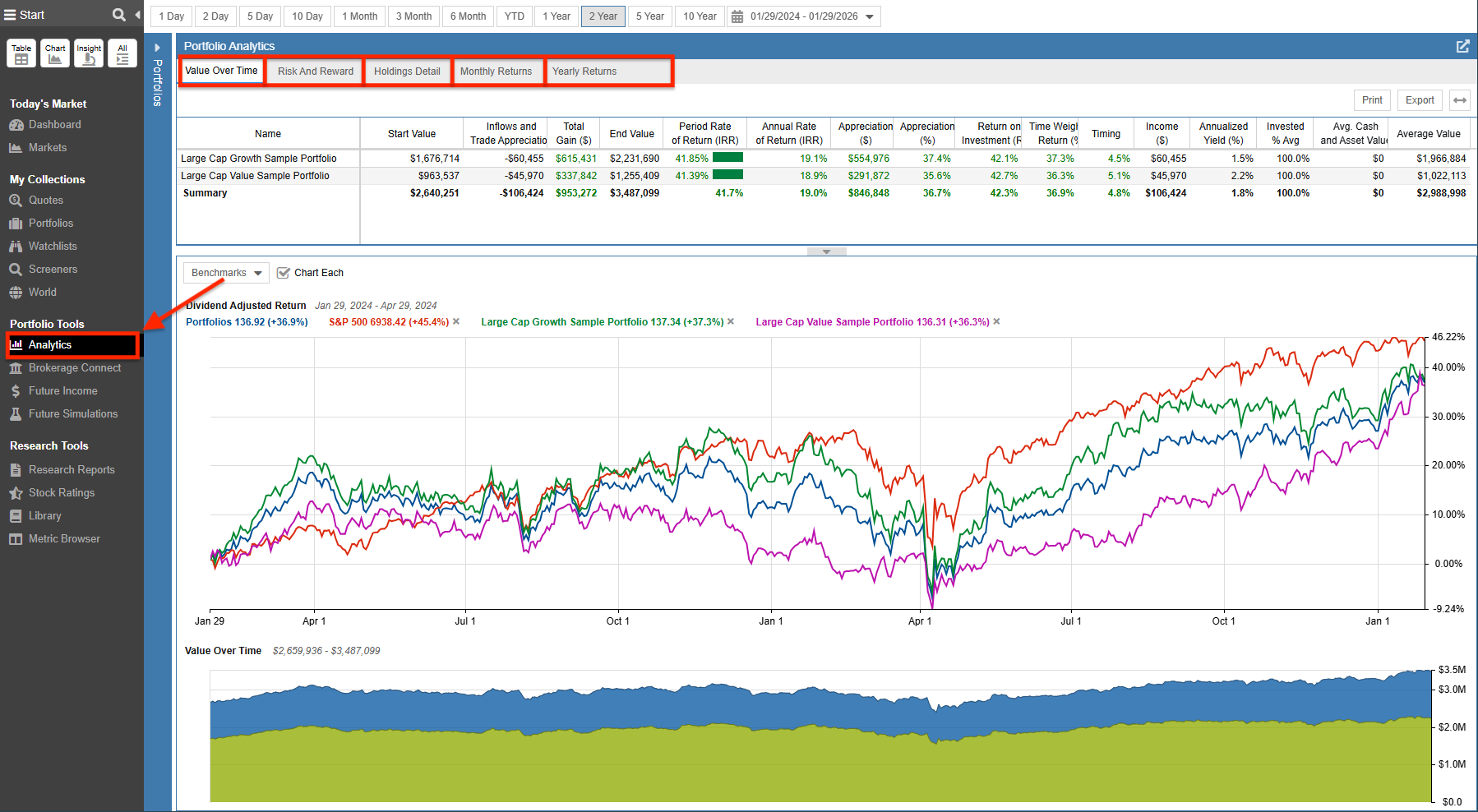

The Analytics [6] section is your “truth serum.” It allows you to visualize your performance over any time period and, crucially, compare it against a benchmark (like the S&P 500) to see if you are truly adding value.

The Analytics tool is divided into five specific views, each answering a different question about your financial health:

2. Cash Flow Clarity: The Future Income Tool

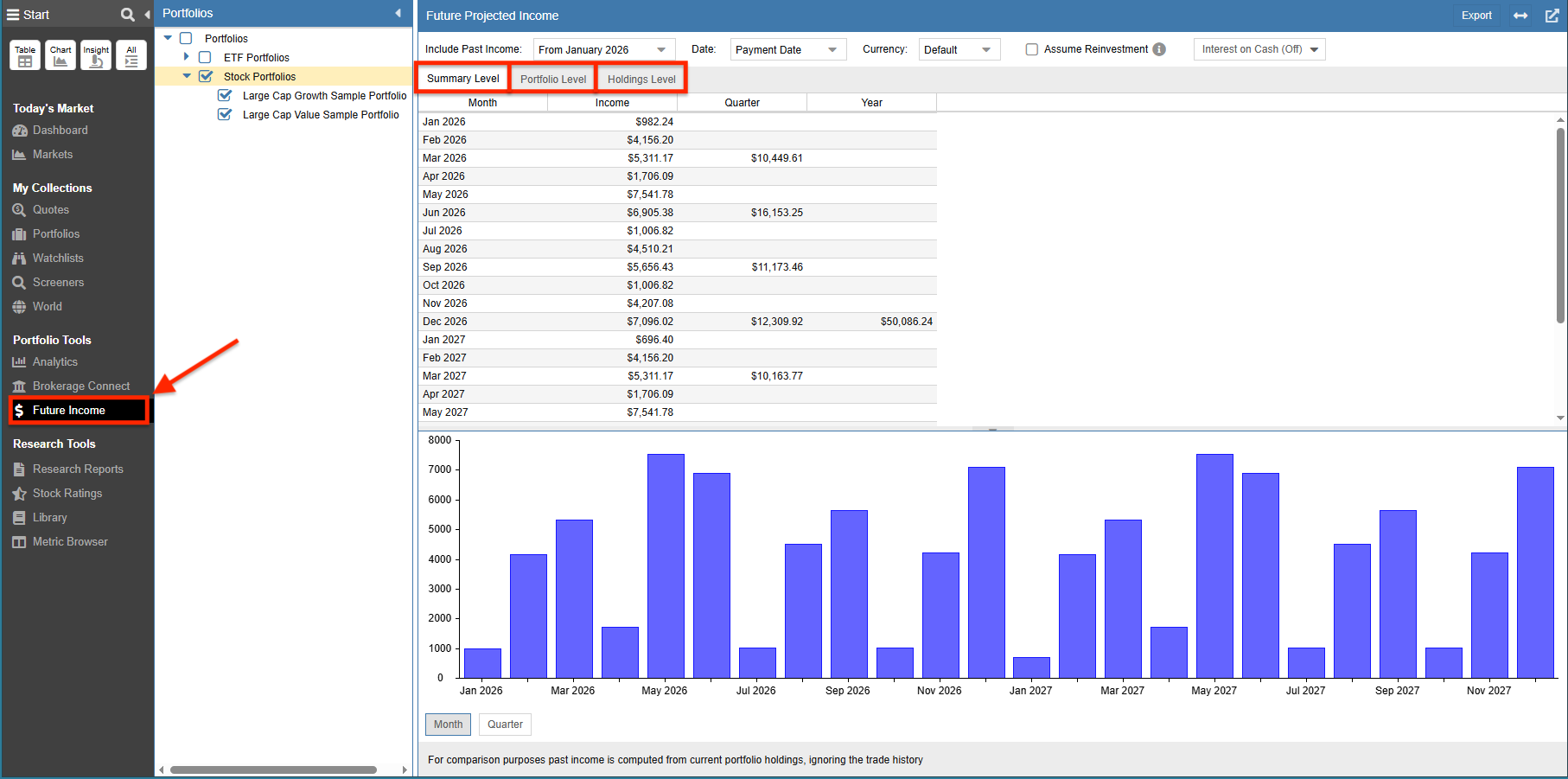

For dividend investors, “total return” is often secondary to reliable cash flow. The Future Income Tool [13] projects your expected dividend income for the current year and the year ahead based on your current holdings.

It offers three levels of detail to help you budget with precision:

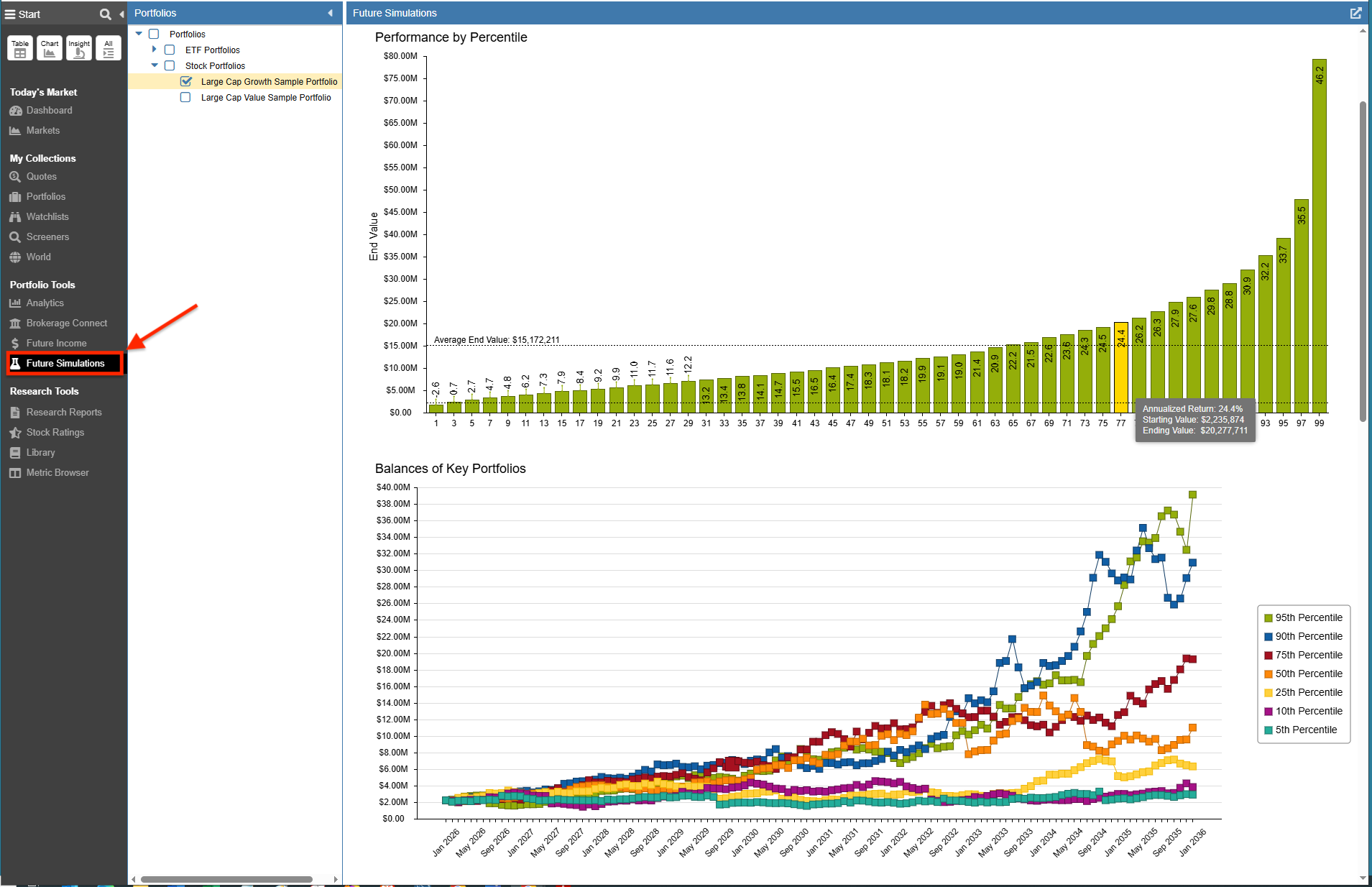

3. Stress Testing: Future Simulations

Historical data is useful, but what about the future? Stock Rover’s Future Simulations [15] tool performs a Monte Carlo simulation to stress-test your portfolio against thousands of random market scenarios.

It allows you to model thousands of potential future paths to answer “What if?” questions with specific visual tools:

Common Questions About Portfolio Analytics

How does Stock Rover Portfolio Analytics compare to standard brokerage reporting?

Unlike standard brokerages that often show simple percentage gains, Stock Rover uses Time-Weighted Return (TWR) to benchmark performance against indices like the S&P 500. This method eliminates the distortions caused by cash inflows and outflows, providing a true measure of your investment skill.

How does the Future Income Tool forecast my dividends?

The tool projects income by checking your current holdings against recent dividend payment history. It assumes the current dividend rate will remain constant (it does not speculate on future increases), while using historical payment schedules to estimate the specific payment dates for the current and following year.

Note: Advanced Portfolio Analytics, Future Income, and Future Simulations require a Premium or Premium Plus subscription. You can explore all plan options here [17].