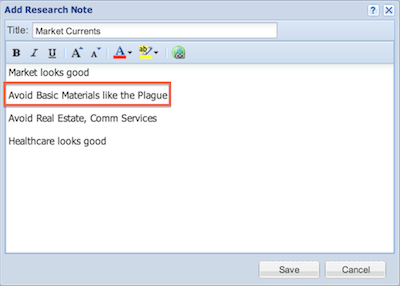

Welcome back to the second installment in this five-part series that recreates the research demonstrated in June 11th’s Introduction to Investment Research Webinar [1]. In our first post [2], I showed you how to get a feel for market and sector performance with Stock Rover in order to understand the investing environment we are in. To recap from that post, in general the market looks bullish, but we want to avoid the sectors of Basic Materials, Real Estate, and Communication Services because they’ve been underperforming the S&P 500.

So, on to actually finding some stocks to research. For this, we employed Stock Rover’s powerful screening facility (for a primer, see our tour [3], or one of our videos [4]). We could run a standard screener, which would just filter out stocks based on criteria. But instead we are going to use a quant screener, which not only can filter the stocks, but also ranks the passing stocks based on user-defined weightings of the screening criteria. We’re going to use our Dividend Growers Quant screen. (By the way, you can tell that it’s quant screen because it’s icon has a “Q” in it in the Navigation panel.)

Why are we looking at dividend growing stocks? In general, investors like stocks that pay dividends. Many investors believe that the requirement to pay dividends regularly cause companies to be more disciplined with their capital management. If a company is growing its dividend, it likely means it is growing its business as well. And historically such compaines perform well in the market. In fact, below you can see all the stocks that currently pass my Dividend Growers screener charted against the S&P 500 over the past five years. As you can see, they collectively outperformed that S&P by 125%.

[5]

[5]

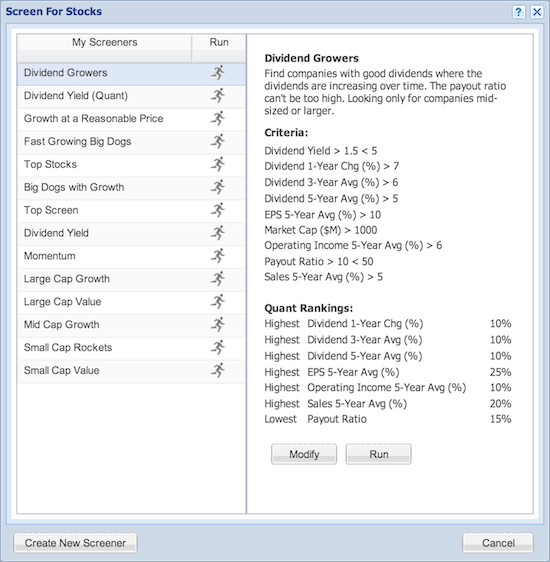

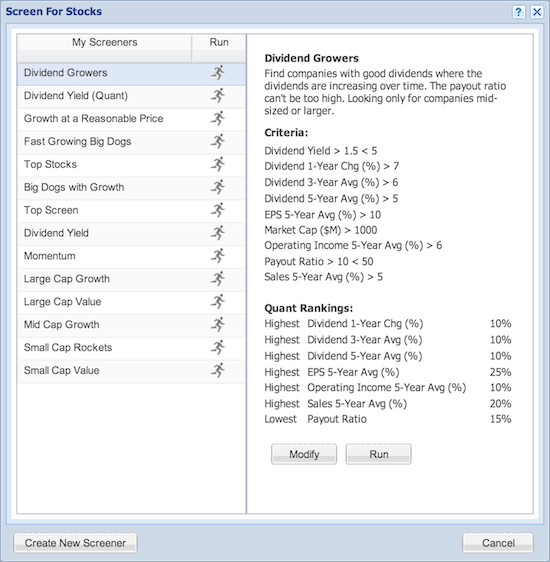

So, to see what’s in this screener, click “Screen for Stocks” in the Task Wizard, and then select Dividend Growers. You’ll see the following parameters.

[6]

[6]

So we’re looking for medium and large companies (with market cap greater than $1 billion) with a dividend yield between 1.5% and 5%, which gives us a solid yield without being too high, which some believe can be a poor sign (though there’s some debate [7] on that.)

[6]

[6]

We want the dividend 1-year change to be higher than the 3-year change, which we want higher than the 5-year change, so we’ll go with values of 7%, 6%, and 5% respectively. This will ensure that the stocks have accelerating dividend growth.

We want sales growth to be greater than 5% per year over the last five years, which is a solid but generally sustainable rate, and we want EPS 5-year average exceeding that at over 10%, which indicates that the sales growth is falling towards the bottom line.

We want a healthy operating income growth of over 6% per year over the last 5 years and a payout ratio between 10 and 50, which means that they are paying out some earnings, but not so much so that they don’t have capital to grow in the future.

Now, for the “quant” part of the ranked screener we can give some or all of these criteria weights in order to actually rank the returned stocks.

We’ll give each of the dividend averages a weight of 10%, with a preference that higher is better. We’ll also give operating income a 10% weight, again with higher as better. We want a lower payout ratio, with a weight of 15%. Finally, we’ll put more weight (20%) on a higher sale growth rate, and the most weight on the highest EPS 5-year average, with 25%.

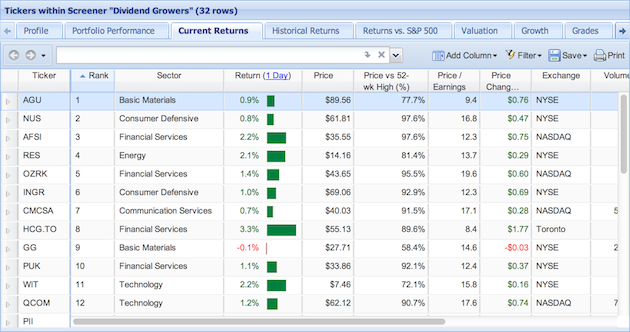

So, after clicking “Run” the stocks that pass the filter criteria will load in the Table, sorted by rank. Below you can see the top-returned results.

You can see that number one is AGU. Normally, we’d investigate this, but right away we see that it’s in Basic Materials. I feel like we had something in our note about that sector…

[9]

[9]

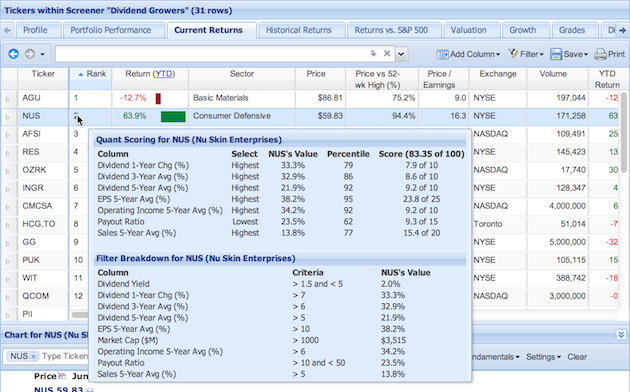

Oh yeah, avoid it like the plague. Let’s move on to number 2, NUS. It’s it in Consumer Defensive, which is not on our “avoid” list so that’s ok. If we mouseover the rank, we can see more information about its quant score.

It looks really strong in all of the screener criteria. If we put it in the Chart, for the past two years, we see it’s shown strong growth, albeit with some volatility.

Link to part 1 – Getting a Feel for the Market [2]

Link to part 3 – Researching a Company [11]