In a contested vote [1] Tuesday, Toyota (TM) shareholders approved a plan to replace up to 150 million shares of common stock (5% of the total) with a new stock class, Model AA. The shares, primarily available in Japan, are aimed at increasing the number of committed, long-term individual investors so Toyota can invest for the long haul with less share price volatility. As investment vehicles, they’re fascinating, and have more in common with convertible bonds than regular equities. Like a bond, they have a fixed periodic payout and present investors the option to recover their principal after five years. Alternatively, they can be converted to common stock five years from now, and thus carry the upside potential of an equity. But they also come with a major catch: transfer of the shares is strictly regulated by Toyota. There’s clearly a lot of opportunity here, but also a lot of opportunity cost.

To determine if Model AA is a good investment, I think we need to consider three questions. The first is whether Toyota’s share price will be high enough in five years that we’d benefit from the conversion to common stock. The second is to whether Model AA’s yield compares favorably to other equity and bond alternatives. Finally, and most importantly, the restrictions on trading Model AA shares require us to consider the opportunity cost of committing capital. Any conclusion will vary not only by what other market opportunities are available, but also by each individual’s liquidity situation, investing horizon, and capital needs. Let’s take a look, data courtesy of Stock Rover.

Contents

Stock Price Upside?

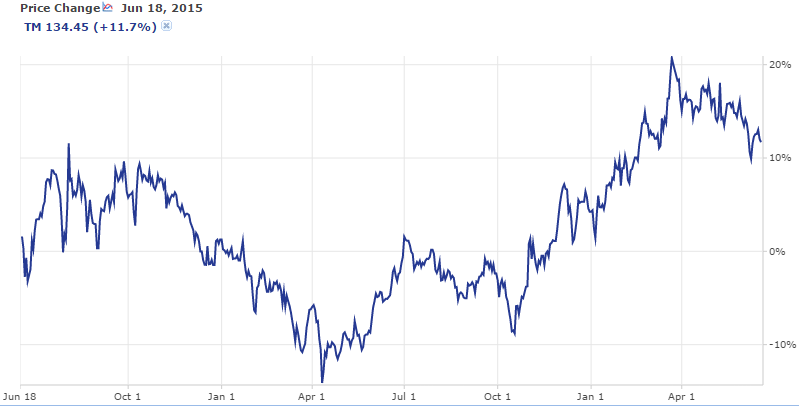

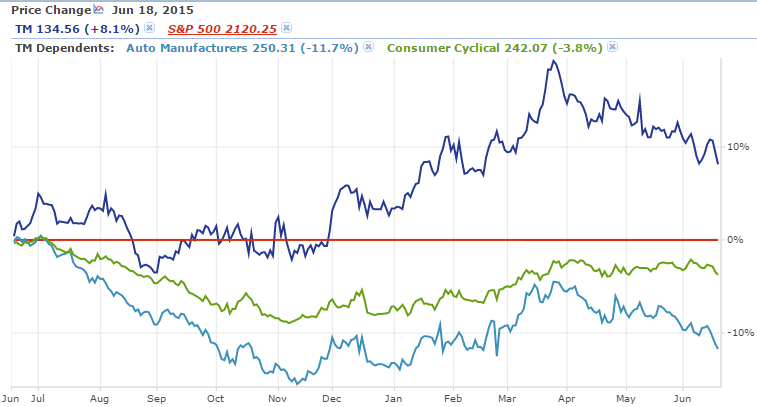

I want to begin this section by saying I have absolutely no idea where Toyota’s stock will be in five years. This is, to quote Donald Rumsfeld, a known unknown. The auto industry is cyclical, and dependent on a number of macroeconomic trends: component prices, gas prices, and especially consumer spending and confidence. Reflecting this, Toyota’s share price has fluctuated pretty substantially: Share prices are up 19% over the past year, but up only 12% over the past two years (see first chart below). Share prices are up 86% over the past five years, but up only 89% over the past 10 (see second chart). When Toyota’s share price has approached its current level in the past 10 years, it has proceeded to decline over the medium term. On the other hand, the company’s EV/EBITDA of 8.2 is near a 10 year low.

Toyota’s performance vs. benchmarks has also been pretty variable. For example, if you look at the past year, Toyota has beaten the S&P 500 by 10%, and beaten other automakers by 21% (see first chart below). But if you look at the past two years, automakers have beaten Toyota by 3.7%, and the S&P has topped Toyota by 16% . Over the past 10 years, automakers have outperformed Toyota by 60% (see second chart below), but over the past five years, that gap has narrowed to just 11%. While both these comparisons show a positive trend for Toyota over the very long term, I think the real point here is Toyota’s share price has a mixed record historically.

Ideally, we’d be able to assign probabilities to the chance of Toyota’s shares hitting certain price thresholds, and then calculate an expected value for their share price five years from today. In reality, this is impossible with any degree of certainty. I think Toyota is a reasonably well-run car company: Their revenue growth in the past year of 3.9% is exactly even with the industry, and their net margin of 7.6% beats the industry’s 4.8%. Vehicle sales are pretty flat, but the company is cutting costs to improve profitability. Their returns on capital beat the industry by a percentage point or two. Their debt/equity ratio of 1.2 isn’t great, but it beats the industry average of 1.7. Their interest coverage is more than ample, and their free cash flow yield of 1.6% beats the industry’s of -0.8%. Does all of this mean their share price will exceed 120% of current value not any time in the next five years, but exactly five years from now? I still have no idea, and I’m skeptical of anyone who claims to know. Given how high Toyota stock in particular and the equity markets generally are right now, I don’t think it’s safe to factor any share price appreciation into our evaluation of Model AA.

How Does Model AA’s Yield Compare

Model AA shares will yield 0.5% this year, and the yield will increase by 0.5% per year for the next five years. This comes out to an average annual yield of 1.5%, though because Toyota is backloading that yield growth, we’ll have less compounding of returns than if we got a flat 1.5% annual yield rate.

First, let’s compare this yield rate to the dividend yield on Toyota common stock. As you can see in the table below, Toyota’s dividend yield has fluctuated a fair amount over the past ten years, but at an average rate of 1.97%, we can expect more return from the common stock. In a recent address, Toyota’s president said the company will continue to pay dividends “stably and sustainably, while flexibly considering share buybacks.” My guess is that as long as Toyota’s earnings stay relatively strong, we can continue to expect around a 2% dividend yield. Of course, common stock comes with the risk of both share price and dividend reductions, but also presents slightly more dividend upside.

Compared to a five year Treasury note or certificate of deposit, Model AA’s yield starts to take a beating. The yield on five-year T-notes is 1.7%, and a quick internet search brings up five-year CD rates in the 2.20% range. If you believe Toyota’s five year share price will exceed 120% of its current price plus a 0.7% difference in annual yield, Model AA is a decent bet for you. But if you don’t have that confidence in Toyota’s common stock, you’d be better off with one of these other instruments.

Transfer Restrictions and Opportunity Costs

The transfer restrictions ruin Model AA for me because of the opportunity cost. Simply put, I think I can beat the returns Model AA is offering over the next five years. The transfer restrictions make sense from Toyota’s perspective: The whole point of Model AA is to increase the number of committed, long-term individual investors so the company can invest for the long haul with less share price volatility. But while locking investors in may be good for Toyota, I don’t think it’s good for me.

Let’s revisit our comparisons to common stock, T-notes, and CDs with liquidity in mind. While common stock does carry more downside risk, it also allows me to get out if I either see bad things in Toyota’s future or see good things somewhere else. T-notes don’t have the same capital upside potential as Model AA, but they have a slightly higher yield and more liquidity. With a CD, you’d have similarly little liquidity, but a substantially higher yield. I don’t see Model AA as a terrible place to put your money, but it definitely looks like a sub-optimal investment when you consider other options.