In my last article [1], we looked at which company between Dish (DISH) and Comcast (CMCSA) was better positioned to handle cord cutting. Then, in last week’s webinar [2], we looked at valuation, growth potential, management, and efficiency. To conclude this series, I will examine the growth strategies of both companies in depth, then review my findings on efficiency, and take a quick look at valuation.

When I say growth strategies, I mean the actions that management has taken to increase future cash flows. These include, among others: expanding the core business, venturing into new markets, reducing costs, improving efficiency, upgrading infrastructure, and making new acquisitions. In line with my earlier findings, Comcast once again appears to be the better pick, having both a less risky and potentially more lucrative growth strategy. Plus, its historical excellence in capital and operational efficiency provides further confidence that it will execute its strategy well. Let’s get into it.

Contents

Watch the Capex

A good growth strategy involves not only defending one’s customer base (read: market share) but also exploiting the evolving trends within the base. As we saw in the first article, the number of video subscribers is declining for both companies, as they shift to online streaming (cord cutting) while internet subscribers are rising as customers need an internet connection to access online content. While both Comcast and Dish are attempting to defend against cord cutting by starting their own online streaming services or investing in joint ventures, only Comcast appears to be taking advantage of the increasing number of internet subscribers.

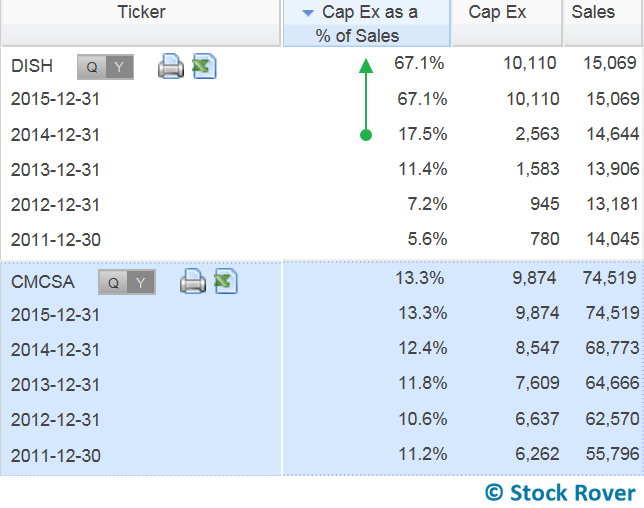

While it is a good sign that Dish’s capex as percentage of sales skyrocketed to 67.1% in 2015 from 17.5% in 2014 and passed Comcast’s (as shown in the table below), suggesting the company is making major investments in its growth, we should look at where the dollars are going to see if this is really a positive.

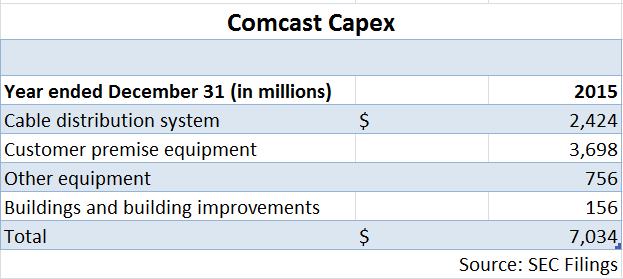

First, let’s see what Comcast has been doing with its capex, which has only increased very modestly in the past 5 years. Comcast spent $9.9 billion on the deployment of its IP and clouded-enabled video platform (X1 platform) and wireless gateways to residential customers, enhancement of network infrastructure and improvement of customer service. $7 billion out of the 9.9 billion (71.3%) went to Comcast’s core business—cable. The following table shows Comcast’s cable capital outlays:

It is apparent that Comcast is not only trying to retain its video customer base by investing in the X1 platform and customer premise equipment (modems, routers etc.), but it is also attempting to exploit the growing internet subscriber base by upgrading its infrastructure (cable distribution system) to increase network capacity.

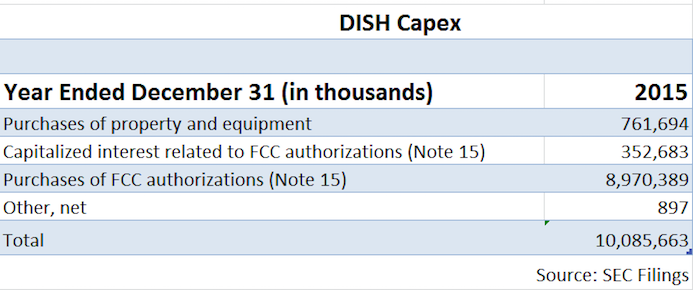

Dish, on the other hand, spent $10.1 billion on wireless spectrum licenses, acquiring interests in companies with wireless spectrum licenses, and upgrading infrastructure according to its most recent cash flow statement [8]. $9.3 billion out of the $10.1 billion (which amounts to 92.2%) went to acquiring spectrum licenses—Dish’s non-core business. Dish’s capex details are shown below (spectrum license expenditure = capitalized interest + purchases of FCC authorizations):

From the large expenditures on non-core business; it stands to reason that Dish is losing sight of its bread and butter and chasing new non-core-markets. 99.2% of Dish’s revenue last year was subscriber-related and the remaining 0.8% was from equipment sales and other revenue. Spectrum licenses contributed very little, if anything to revenue. Dish starting Sling TV to defend its video customer base against cord cutting was a good move to capitalize on macro trends. However, they are now only spending less than 8% of capex (the first line in the table above) on maintaining and upgrading network infrastructure that supports the growing internet subscriber base. To me, that reads as a misallocation of resources, especially when their internet subscriber numbers are growing.

In Dish’s defense though, the future of pay TV is online and mobile, so both internet service providers (ISPs) and phone companies stand to benefit in the long run. It is understandable and commendable that Dish try get into the phone business as well. Additionally, with DirecTV (its competitor) merging with AT&T, Dish may be under pressure to get into the mobile space—buying wireless spectrum licenses gives it better leverage with phone companies. Buying licenses gets Dish in the right position to merge with phone companies (Dish tried and failed merge with sprint and it may target T-Mobile in the future). But just because Dish’s peers are merging with phones companies, does that mean it is the right direction for Dish as well?

Even though customers are increasingly relying on mobile devices, they still need an internet connection to access much of that streamed content, especially in their homes. If you are like me, your data turns off and your Wi-Fi turns on once you are in the house. Unfortunately, Dish spending 8% of capex on infrastructure does not signal a concerted effort to improve its internet services or network capacity.

The Risk We See But Haven’t Addressed

Programming costs aka affiliate fees are a strong undercurrent in the pay TV industry—they are the biggest expense for most pay TV providers. Both Comcast and Dish cite rising programming expenses as risks to their business. However, Comcast did something about it, while Dish has been content to just talk about it. To hedge against rising affiliate fees, Comcast acquired NBC. Increasing programming costs mean additional revenue for NBC—since it creates and acquires content—and ultimately more revenue for Comcast. In contrast, Dish admitted in its 2015 10-K [9] that “unlike our larger cable and satellite competitors, some of which also provide IPTV services, we have not made significant investments in programming providers.”

If almost all your revenue comes from TV, and the cost of providing that TV is rising, I think that hedging yourself against those rising costs should be more of an immediate concern than venturing into new markets. Especially because increasing programming costs are incurred on a per subscriber basis, and the number of subscribers, as we saw in the first article, is falling. Regrettably, Dish seems more focused on acquiring spectrum licenses than hedging against increasing affiliate fees. What happened to a bird in hand is worth is two in the bush?

Capital and Operational Efficiencies—A Great Divergence

Growth, overtime, is almost impossible to achieve without improving both operational and capital efficiency. Operational margins such as gross margin, EBIT margin, and net margin measure how well a business is run, while capital margins like ROE, ROA and ROIC measure how well a company employs capital. The higher these margins are the better, but most importantly investors want to see a rising trend. When it comes to our two peers, we see that Comcast’s operational and capital efficiencies have been improving over the years, while Dish’s margins have been slowly deteriorating.

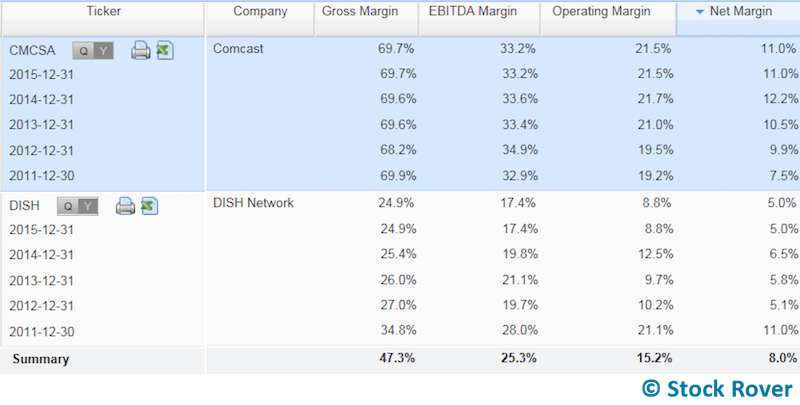

The following table shows both Comcast’s and Dish’s operating margins:

These numbers suggest that, instead of getting better at running its business overtime, Dish is actually getting worse. For example, the falling gross margin means that Dish is not able to grow revenue at a pace greater than the cost of sales growth rate, and this erosion hurts the other margins as well. By contrast, Comcast has kept its gross margin relatively the same while improving other margins.

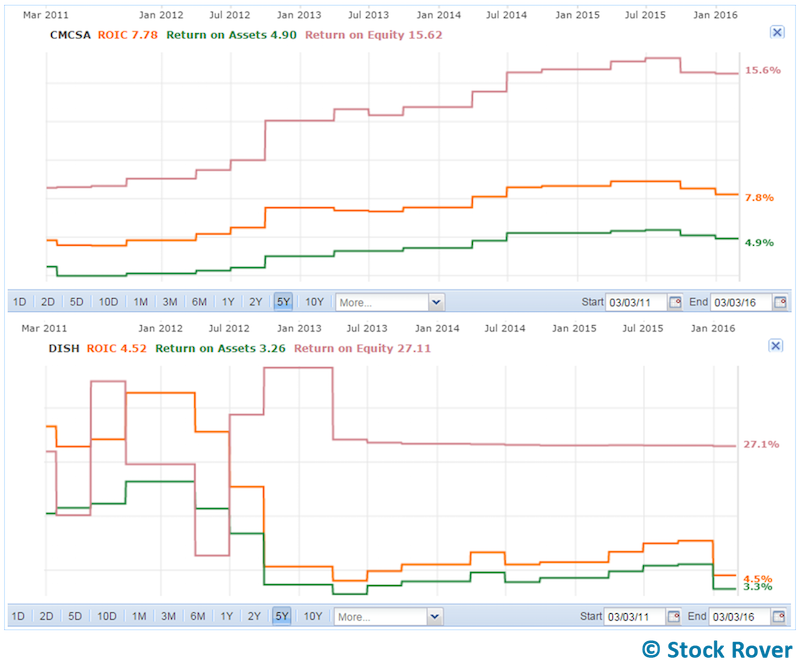

On capital efficiency, we also see that Comcast become a better employer of capital compared to Dish over 5 years, as shown below. Comcast is the first chart, Dish is the second.

The same is true when I charted the past 10 years. Dish’s falling capital margins (with the exception of ROE, in pink—but more on that later), especially ROIC (in orange), indicate Dish is becoming more inefficient is putting capital to work and competing with peers.

ROA measures a company’s ability to generate revenue, and it accounts for capital structure by including both debt and equity into the calculation. ROIC (a less common but very useful metric, calculated as net operating profit after taxes divided by invested capital) indicates how well a company is able to employ capital. A falling ROIC signals a firm may be having trouble dealing with competition, while a rising ROIC points to a business that is increasingly doing better than its peers. In our case, it is apparent that Comcast is leaving Dish behind because its ROA and ROIC (as well as the ROE) are rising. This brings me to a point about ROE. Even though Dish’s ROE (measured as net income divided by shareholder equity) is higher than Comcast’s, it is not a compelling advantage, because ROE does not account for debt, so companies with a lot of debt tend to have higher ROEs than those with low debt, because they have additional source of capital they can use to generate net income. And Dish does have more debt relative to equity than Comcast: its debt to equity (D/E) ratio is 5 compared to Comcast’s 1. Both companies carry debt, but Dish’s is near the highest in the industry.

The takeaway is that as Comcast is becoming an increasingly well-oiled business over time, Dish isn’t. Unfortunately, becoming more inefficient in operations and in the employment of capital is not a good growth strategy.

Mr. Market is Off on Valuation

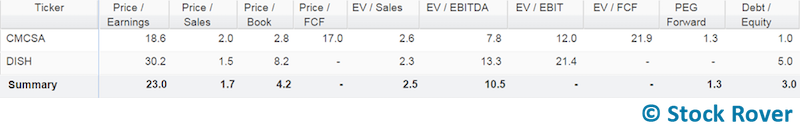

In spite the fact that Comcast is developing its core business, hedging against rising programming costs, operating a well-oiled machine, and putting its capital to better use, it is also trading at lower multiples than Dish:

While it is not cheaper in every metric, Comcast is trading at a lower Price/Earnings, Price/Book, Price/Free Cash Flow, Enterprise Value/EBITDA, EV/EBIT, EV/FCF and PEG forward (Dish’s Price/FCF, EV/FCF and PEG Forward don’t have values because of Dish’s negative FCF and estimated EPS growth). Unless you think of Dish as a growth play and have reason to believe that it can work through its shortcomings and effectively execute its strategy, then it is overvalued when compared to Comcast, pure and simple.

Conclusion

All of my research on these two companies has shown Comcast to be the winner in most regards. By focusing on upgrading its infrastructure, Comcast will increase its network capacity and be able to take on the increasing number of internet subscribers, while Dish appears to be neglecting this opportunity by attempting to enter the mobile space. By acquiring NBC, Comcast hedged against rising programming expenses whereas Dish, even though acknowledging that increasing affiliate fees are a significant risk, has not taken any action to mitigate that threat. By improving its operational and capital efficiency, Comcast is only becoming more dominant and widening its economic moat, while Dish is losing market share as it becomes a less efficient business and an ineffective employer of capital. Finally, despite Comcast having a sounder growth strategy, it is the company with lower valuation multiples. I think it’s clear which is the high-speed, high-definition stock. Happy streaming!