The Alaska-Virgin deal, though expensive, achieves two strategic goals: 1) it eliminates some of the competition, and 2) creates room for future expansion. As you probably know Alaska Airlines (ALK [1]) agreed to buy Virgin America (VA [2]) for $57 a share—that’s a 42.7% premium from VA’s closing price on April 1. While I do not like the fact that ALK may be overpaying for an airline with falling margins, I understand why it had to be done. The short-term uncertainty and margin reductions it may create notwithstanding, the deal brightens Alaska’s long term prospects. It makes the fundamental case for Alaska stronger and I will be retaining Alaska in my Large Cap Capital Appreciation Portfolio [3]. If the price drops below $77, I may add to the position.

Contents

Before JetBlue, There Was Delta

To understand why Alaska offered to buy Virgin America and at so high a price, we need to look at what has been happening to the airline market on the west coast. Specifically, we should look at passenger numbers (read: market share) at Seattle/Tacoma International Airport, Alaska’s home turf.

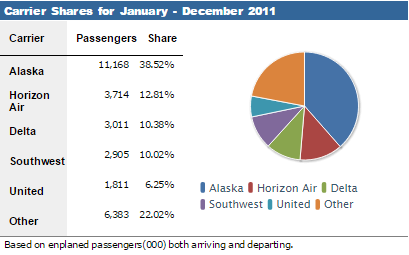

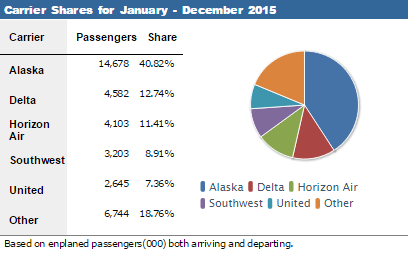

The chart above shows the share of passengers carried by each airline at Seattle/Tacoma International Airport in 2011, according to the Bureau of Transportation. Alaska had the biggest share at 38.52%, followed by Horizon Air at 12.81% (also owned by ALK), while Delta came in third with 10.38%. Fast forward to 2015 and the chart looked like this:

In the four years, Alaska has increased its market share to 40.82% and remains the dominant airline at this airport. Delta increased its market share to 12.74%, surpassing Horizon Air in second place.

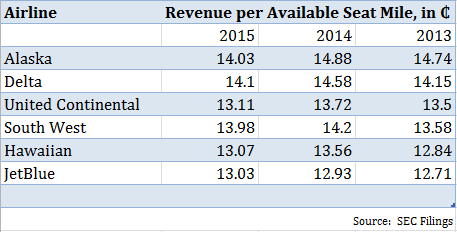

It’s clear that Delta is aggressively expanding in Seattle and other west coast cities because these are high-growth high-margin areas. According to the most recent earnings call [8], Delta management revealed that “we have remained focused on expanding service in higher margins areas such as New York, Seattle and Los Angeles.” This has been borne out by Alaska’s Revenue per Available Seat Miles (RASM)— a profitability metric calculated by dividing operating profit by Available Seat Miles (ASM, ASM = number of seats on a plane × number of miles flown)—which has historically been the highest among the airlines as shown below:

Alaska recognizes this competition and has been taking measures to defend it market share. For instance, it has increased capacity (ASM by 11% in 2015), expanded to into 20 new markets, and increased promotion activity in Seattle and new locations. All these measures would have been enough for Alaska to keep the competition at bay, but JetBlue’s (JBLU) (an east coast airline) attempt [9] to acquire Virgin was perhaps what made the competitive threat more real for Alaska.

An Offer Virgin Could Not Refuse

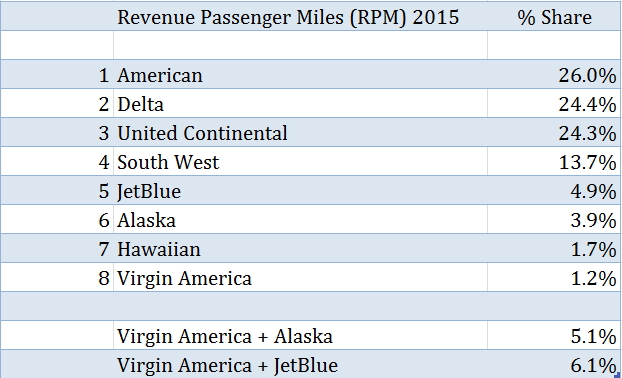

If JetBlue had acquired Virgin, it would not only have gotten a foothold on the west coast but also strengthened its position as the fifth largest airline in the country as shown the table below:

JetBlue would have increased its market share (measured by Revenue Passenger Miles—RPM, RPM = Number of passengers × number of miles flown) to 6.1% while Alaska would still have 3.9%. That, plus the possibility of having JetBlue become a significant actor on the west coast, is what—I believe—convinced Alaska to make an offer Virgin could not refuse. Alaska could simply not tolerate more competition in addition to what it was already facing from Delta.

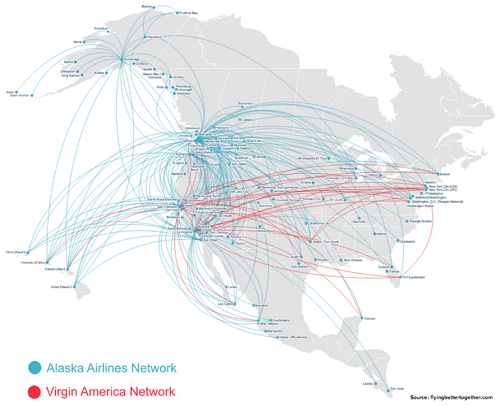

By offering such a premium, Alaska is indicating just how important it sees this opportunity to simultaneously stem competition and increase market share. If the acquisition is completed, Alaska’s market share as shown above will increase to 5.1%—surpassing JetBlue as the fifth largest US airline. Additionally, Alaska will gain access to Virgin’s markets on the east coast:

So the deal gives Alaska greater scale, but also presents profitability challenges. Alaska will increase its presence in San Francisco and Los Angeles and gain more routes to Boston and New York but will face challenges as a result of Virgin’s lackluster margins. Virgin has falling margins (overall) in spite the drop in the cost of fuel, as you can see when it is compared with JetBlue and Alaska:

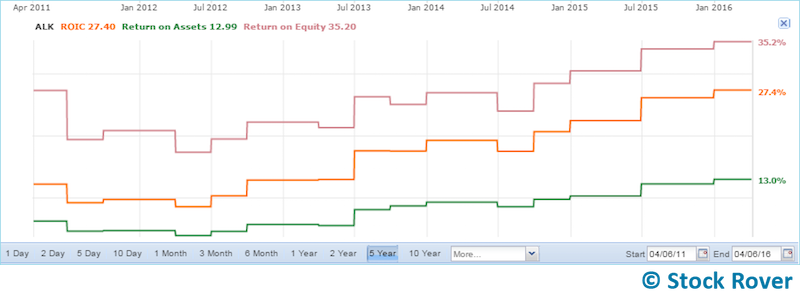

Virgin’s nonfuel cost rose 12.3% in 2015 and without a 30.3% drop in the cost of fuel, margins would have deteriorated further. However, given Alaska’s good grip on margins (its nonfuel costs only rose 9.8% in 2015) and its historical operational and capital excellence (below); it should eventually turn the operation into a profitable venture.

Furthermore, the fact Virgin operates in higher margins areas, namely San Francisco and Los Angeles, makes the challenge of turning Virgin’s margins around easier.

Far From Complete; What Could Go Wrong?

The deal is expected to be completed by January 1, 2017, so it still has a long way to go and depends on approval by regulators and Virgin shareholders. But these are not insurmountable obstacles. Regulatory approval should not be a major concern because the deal will, as shown earlier, only increase Alaska’s market share to 5.1%. Additionally, given the large premium Alaska has offered, approval by Virgin’s shareholders should not be too elusive.

The biggest threat would be a higher bid from JetBlue or another third party. But that’s the reassuring part about the offer Alaska made: it’s high enough to quell such threats, especially from peer airlines. However, there is still risk that one or more of the big four could make an offer, but then antitrust concerns would come into play because they already have significant market share.

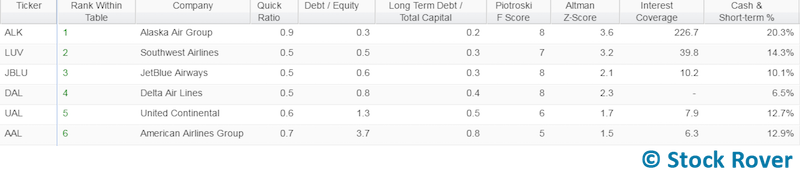

Additionally, Alaska could handle a higher bid, if need be, because it has a very strong balance sheet. A quick glance at its balance sheet reveals that Alaska has the highest Quick Ratio, the lowest Debt to Equity ratio, and the lowest Long Term Debt to Total Capital ratio among its peers:

It scores an 8 on the Piotroski F Score and a 3.6 on the Altman Z Score (with a rising Z score trend to boot). Furthermore, Alaska has the highest cash as a percentage of total assets. If push did come to shove, given that the current deal is all cash, Alaska could add equity to match a higher bid.

Conclusion

Alaska’s acquisition of Virgin is essentially a defensive move to keep Delta and other competitors from taking away its market share on the west coast. But the deal also gives Alaska the chance to play offense on the east coast. As a result, Alaska will able to grow in high margin areas on both the west (San Francisco and Los Angeles) and the east coast (Boston and New York). ALK shareholders should applaud this move.