Contents

- Overview [1]

- Views By Category [2]

- Profile [3]

- Portfolio Performance [4]

- Research [5]

- Ratings [6]

- Price Performance [7]

- Financial Statements [8]

- Dividends [9]

- Additional Metrics and Views [10]

Overview

Stock Rover has well over 600 separate metrics [11] which in aggregate provide a vast amount of operational, financial, price and investment information for individual stocks, ETFs and Mutual Funds. Metrics are organized into Views, which are groups of related metrics that are presented together in the Stock Rover Table. The Table is capable of easy View selection and rapid switching between Views.

Views are totally customizable. You can put any Metric in any View. Stock Rover ships with 22 Views to get you started. Each view covers an investment theme or dimension of investment research. From there, you can use the Views as given, or modify them, add new ones, rename them or delete them as you see fit.

In this blog entry, I will do a brief survey of the Views Stock Rover provides out of the box and highlight some of the key metrics in each of the Views.

After the tour of the Views, I will briefly cover how to find additional metrics in the Stock Rover Metric browser that you may find useful. Any metric can be added to an existing or new View.

I will also briefly cover additional pre-built Views in the Stock Rover’s Investor’s library that may be of interest and can be imported into your account.

Note; there is also a companion video [12] that demonstrates the Views and Metrics available in Stock Rover.

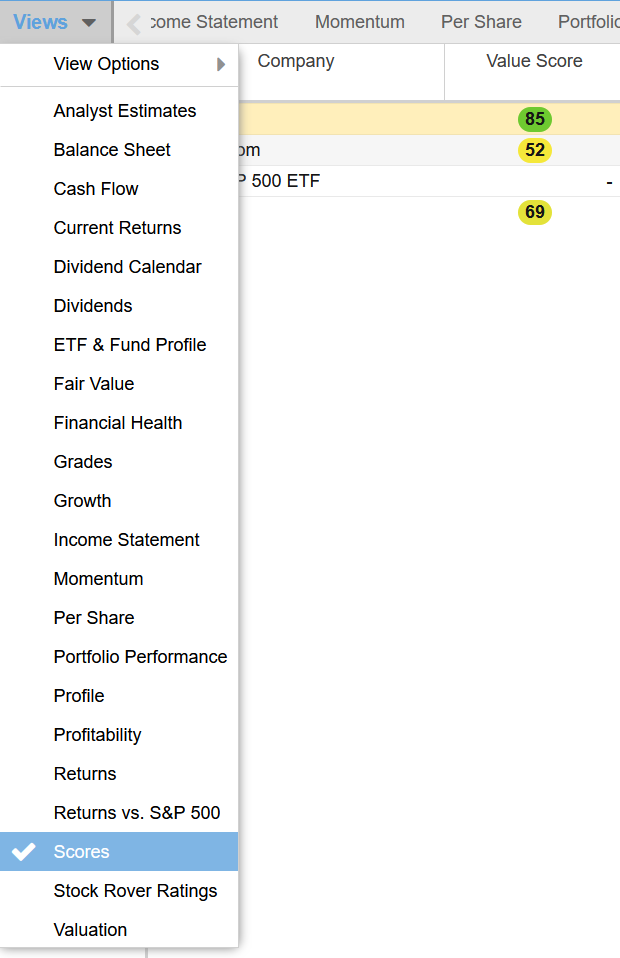

Below is a screenshot of the 22 Views you get when you first set up an account with Stock Rover.

Note; if your account does not contain these exact Views, it was likely established before we set this group as the current set of default Views. If your account is missing Views you would like to have, you can import them via the Stock Rover Investor’s Library [13].

Views By Category

The best way to attack this many Views is to group them into categories so they are more easily explained and understood. The 22 views fall roughly into the following categories:

Profile

- ETF & Fund Profile

- Profile

Price Performance

- Current Returns

- Momentum

- Returns

- Returns vs. the S&P 500

Portfolio Performance

- Portfolio Performance

Research

- Financial Health

- Growth

- Per Share

- Profitability

- Valuation

Ratings

- Analysts Estimates

- Fair Value

- Grades

- Scores

- Stock Rover Ratings

Financial Statements

- Balance Sheet

- Cash Flow

- Income Statement

Dividends

- Dividends

- Dividend Calendar

OK, that looks a bit more organized and digestible. Let’s take a quick look at the Views in each category. For some of the key Views I will include screenshots.

Profile

There are two profile Views, each with a separate purpose.

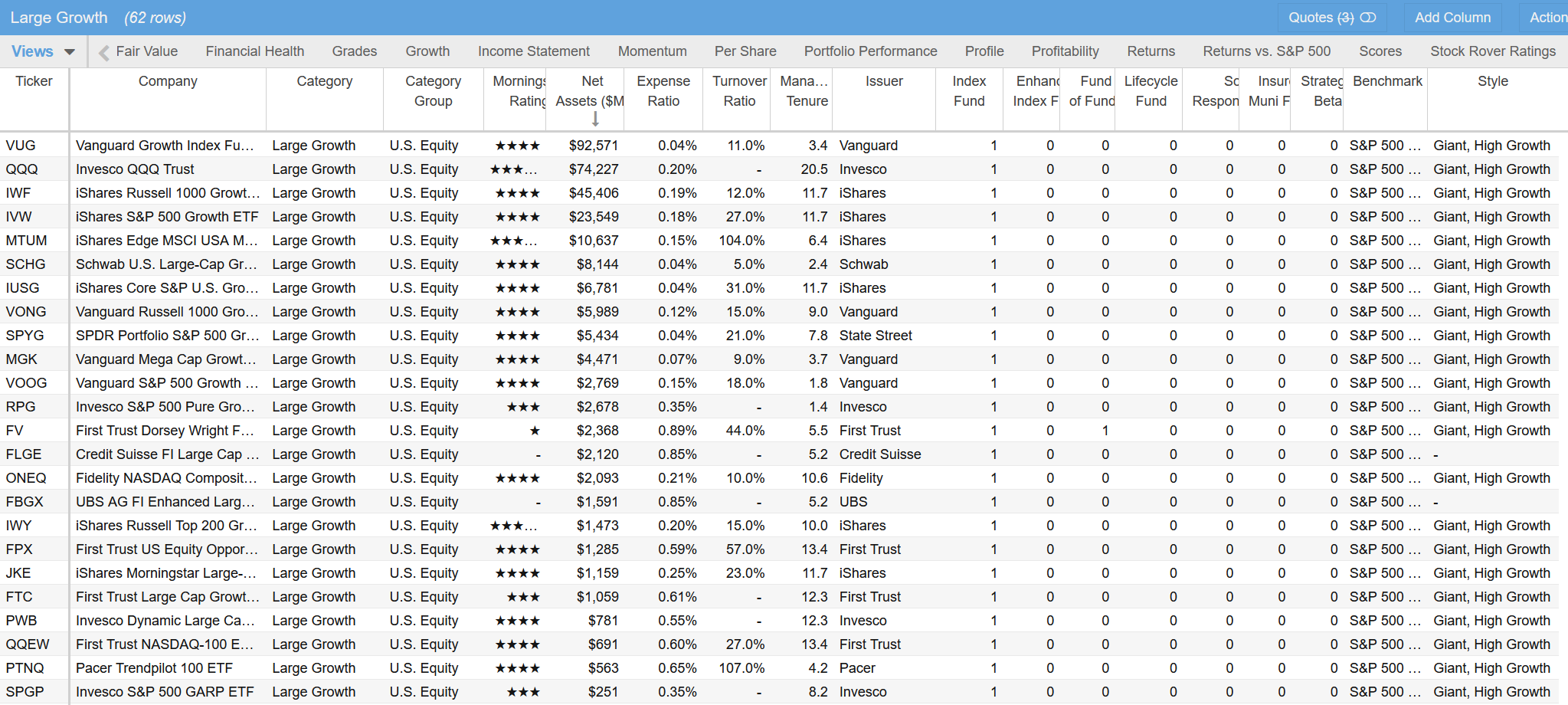

The ETF & Fund Profile View should be used when the dataset in the table consists primarily of ETF and/or Mutual Funds. This view gives a wide breadth of information on ETF and Mutual Funds including category, Morningstar rating, size, expense ratio, turnover ratio, manager tenure, issuer and style.

The Profile View should be used when the dataset in the table primarily consists of stocks. This view provides extensive profile information on stocks including sector, industry, exchange, market cap, sales and employees. The profile also includes Stock Rover’s overall rating for the stock, institutional ownership, share count, dividend information and volatility metrics.

Portfolio Performance

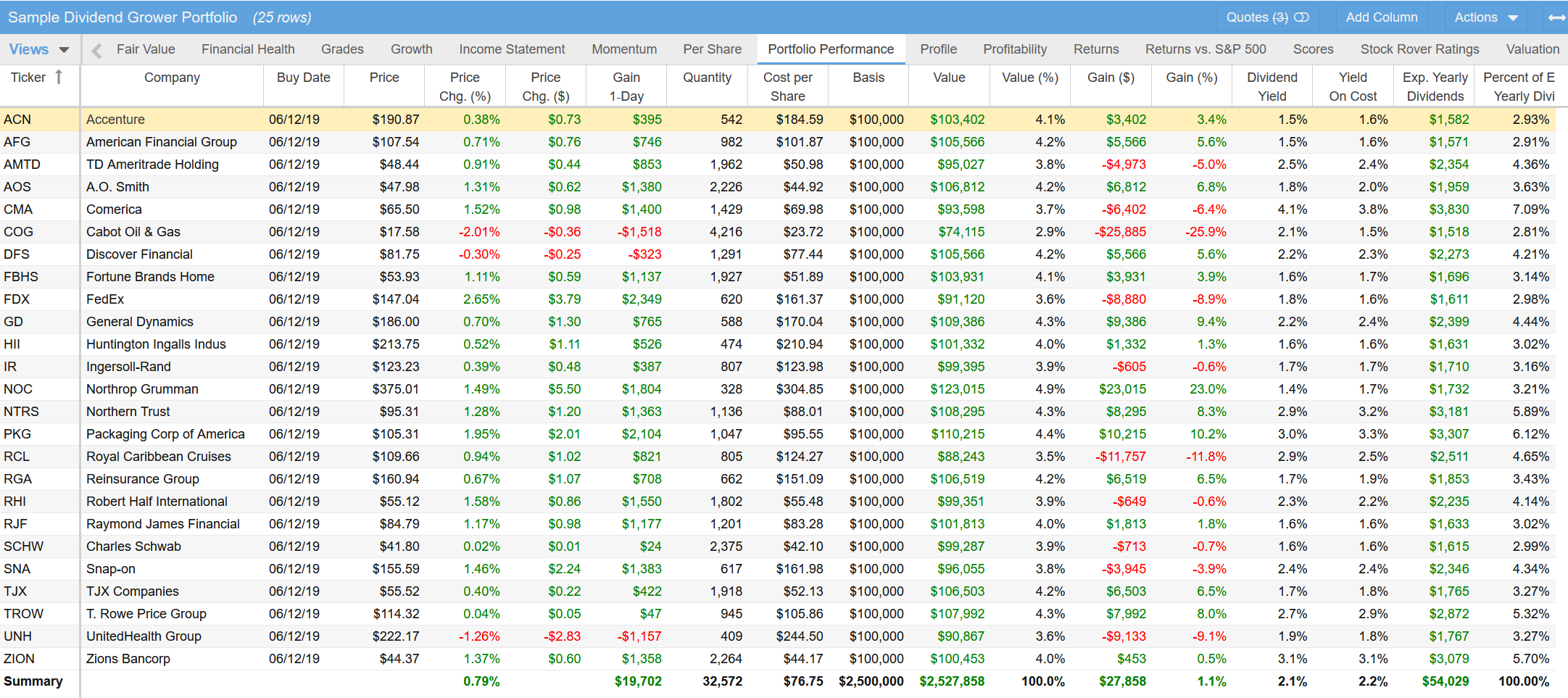

There is one View focused specifically for Portfolios and it should be used when one or more portfolios are selected and displayed in the table.

The Portfolio Performance View gives you a detailed snapshot on the performance of your portfolio, with a special focus on how the portfolio is performing on the current trading day. Additional information includes buy dates, position cost basis and overall gains by position, position value by dollar and percentage of portfolio as well as key dividend information.

Research

The next category is for stock research. There are five Views, each of which provide a different perspective when performing investment research on stocks.

The Financial Health View provides a number of key metrics that indicate the financial health of an enterprise, including Morningstar Financial Grades, the Altman Z-Score, the Piotroski F-Score, Beneish M-Score and the Sloan Ratio as well as a number of debt metrics and the current and quick ratios.

The Growth View provides comprehensive information on Sales and EPS growth over a number of historical periods as well as projected future sales and earnings growth.

The Per Share View displays earnings, cash flow, free cash flow, debt and equity, and dividend metrics on a per share basis.

The Profitability View contains metrics that measure financial performance in a few different dimensions including Return on Assets, Return on Equity and Return on Invested Capital as well as margin information (gross, net, operating and EBITDA), both in absolute terms and vs. peers. More exotic metrics such as the Greenblatt ROC and the Novy Mark Gross Profits / Total Assets are also included in this view.

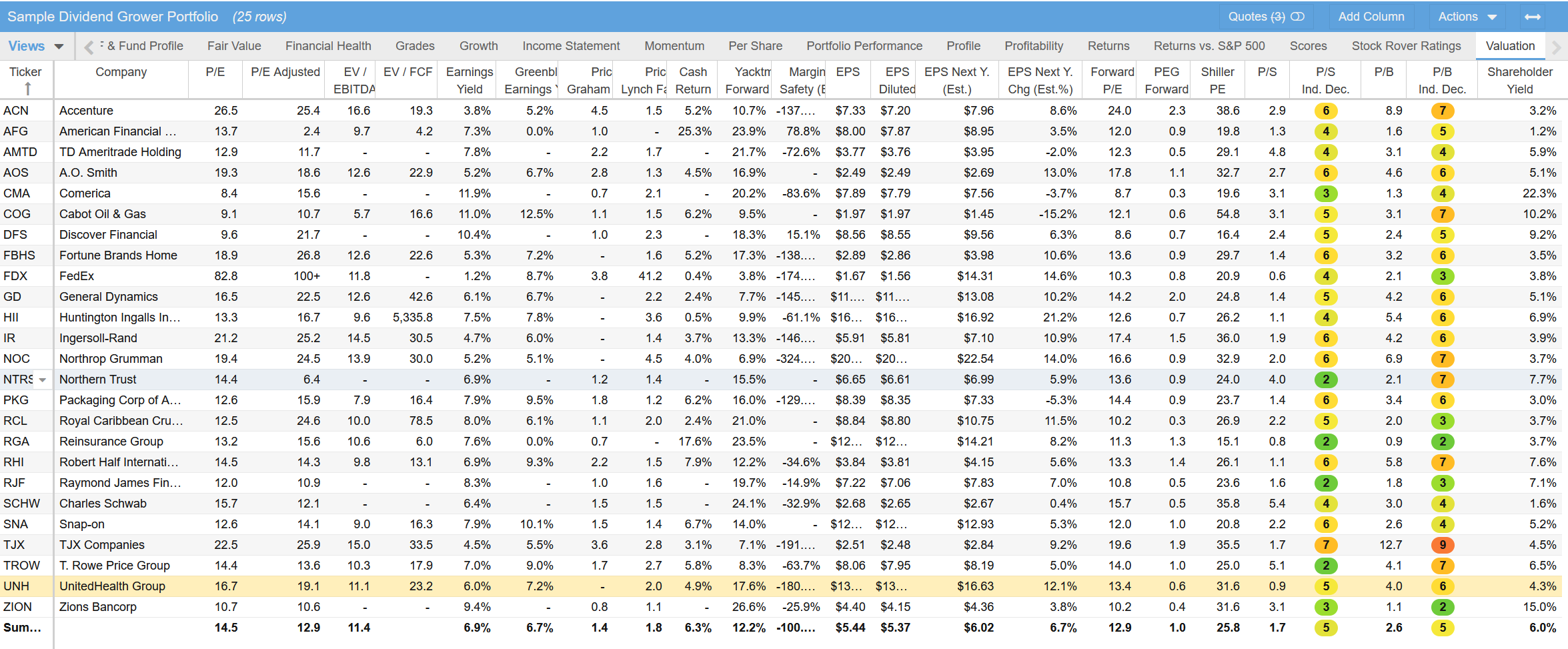

The Valuation View contains a variety of valuation metrics such as P/E, Forward P/E and PEG Forward. Also included are EV / EBITDA, P/S and P/B as well as a whole host of more advanced valuation metrics such as Price to Lynch Fair Value, Shiller P/E and many others.

Ratings

The Ratings Category has five separate Views, with each View focused on a different aspect of getting expert ratings on stocks.

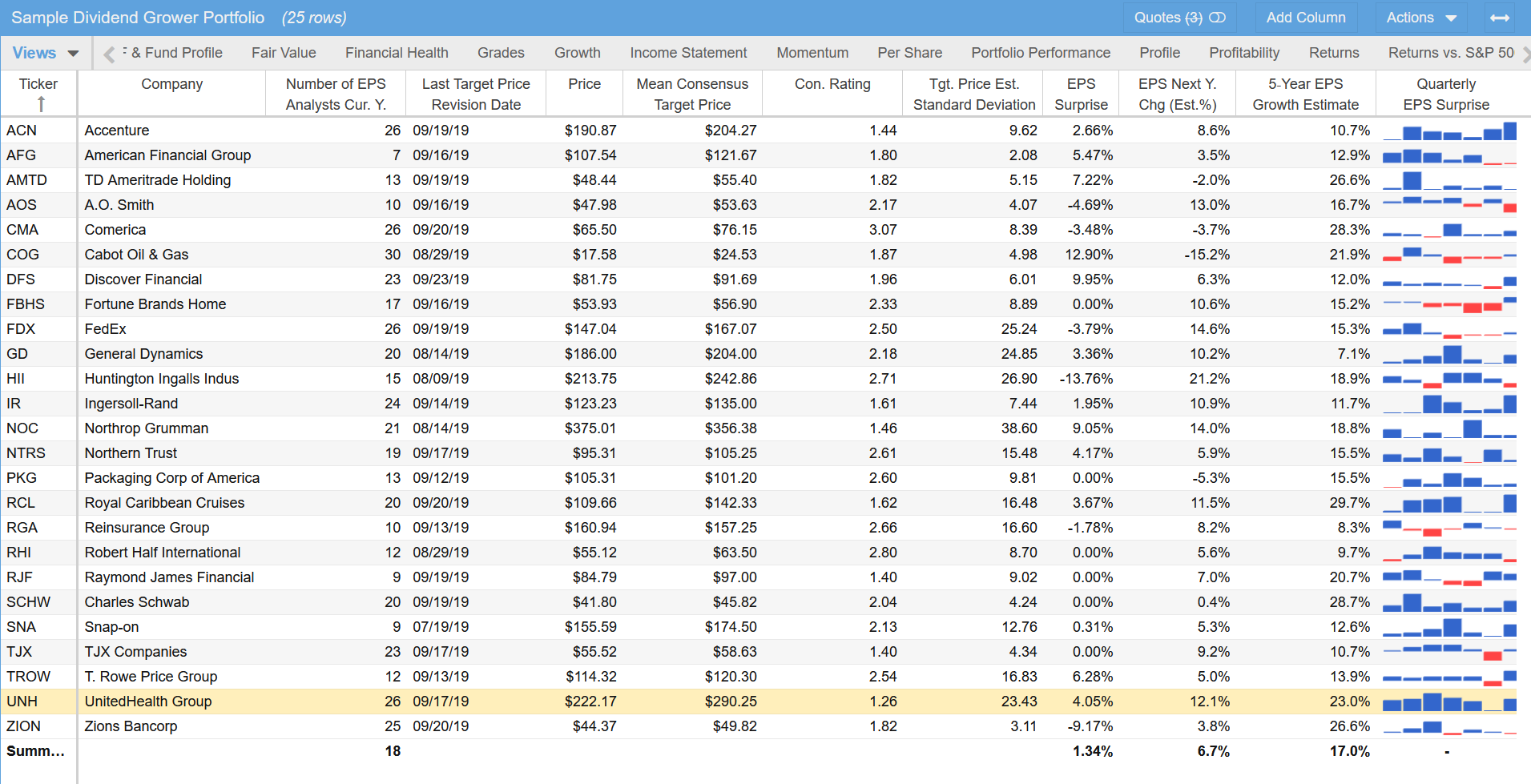

The Analysts Estimates View provides metrics on what the analysts think about a stock including estimates and target prices.

The Fair Value View provides metrics on what Stock Rover thinks a stock is worth using the Stock Rover discounted future cash flow model [20] for computing a company’s intrinsic value.

The Grades View displays metrics on what Morningstar thinks of stocks, graded A to F in various categories. The view also includes Stock Rover-computed deciles for performance within its industry across various factors such as price to earnings, price to book and price to free cash flow.

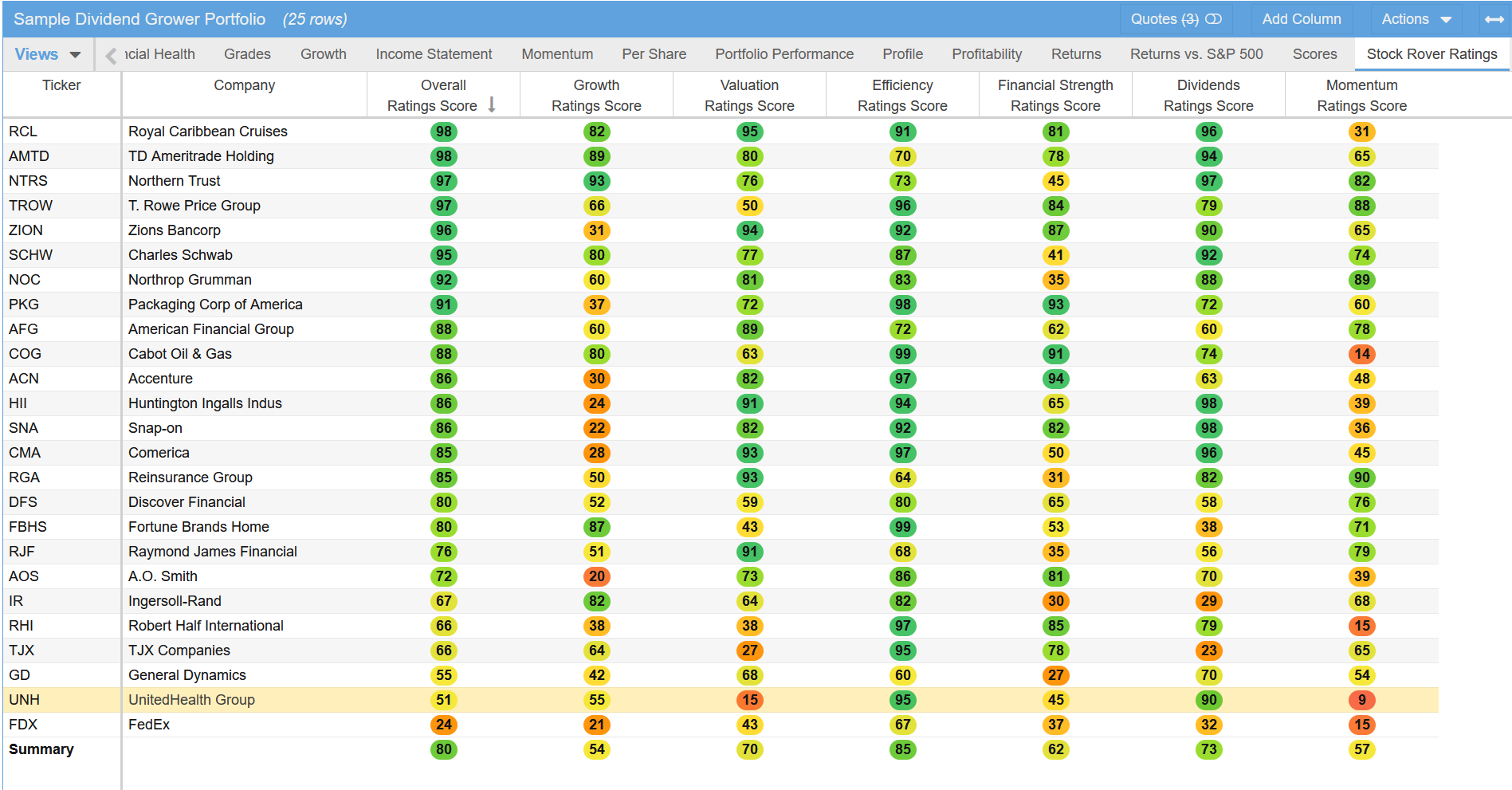

The Scores View displays the Stock Rover scores [21] for a stock for Value, Growth, Quality and Sentiment along with their deciles using the Stock Rover scoring system. Also included are the Altman Z-Score, the Piotroski F-Score and the Beneish M-Score.

The Stock Rover Ratings View displays the Stock Rover Ratings [22] for a stock vs. its peers in the areas of Value, Efficiency, Financial Strength, Dividends and Momentum. The view also includes the overall ratings score which is computed from the component ratings.

Price Performance

The Price Performance Views give you four different ways to examine price performance.

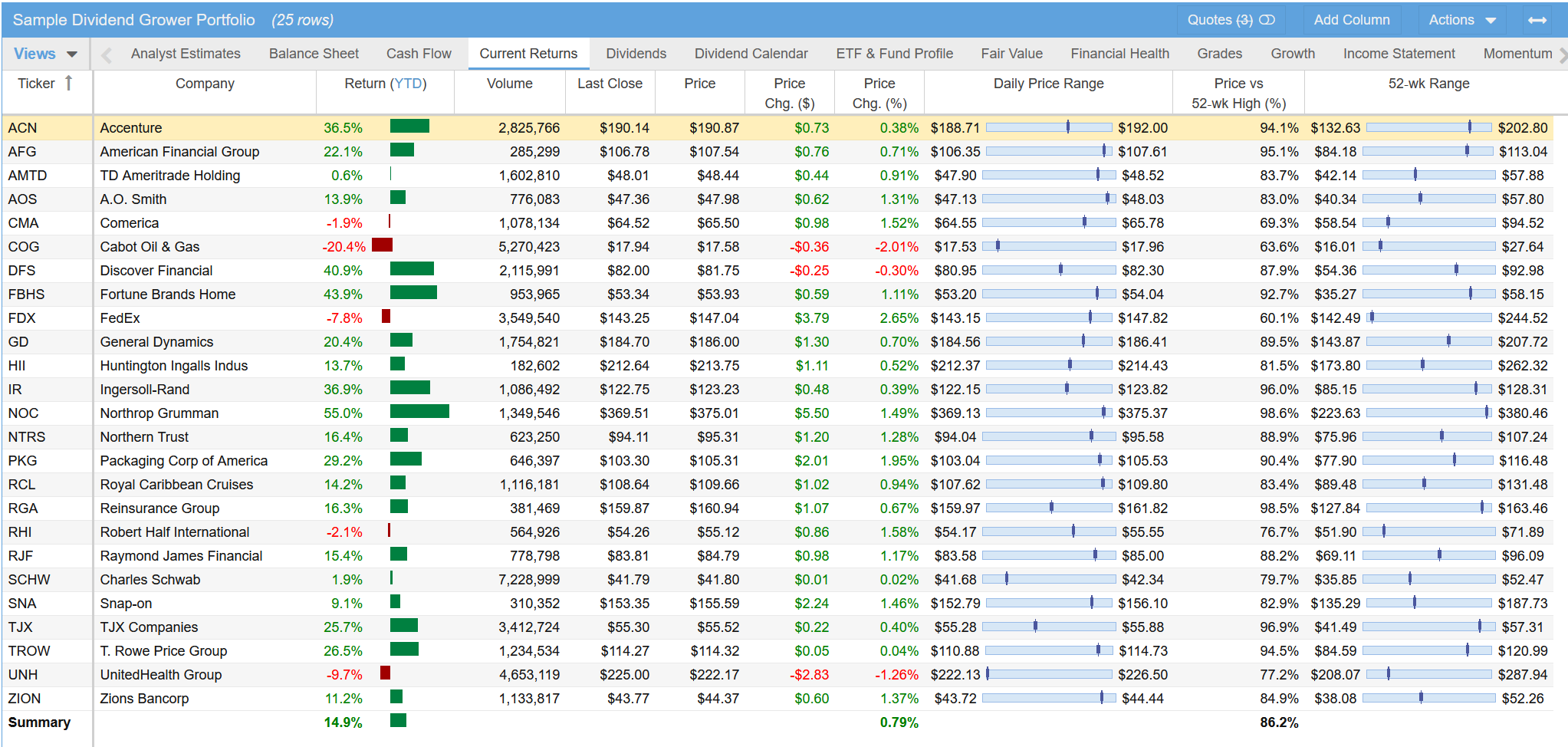

The Current Returns View provides detailed data on the performance of Stocks and ETFs during the current trading day as well as performance over the last 52 weeks.

The Momentum View displays a number of key price technicals such as Simple Moving Averages (SMA), Relative Strength (RSI), Money Flow (MFI) and Bollinger bands.

The Returns View shows price performance, inclusive of dividends, over key periods from one day to ten years.

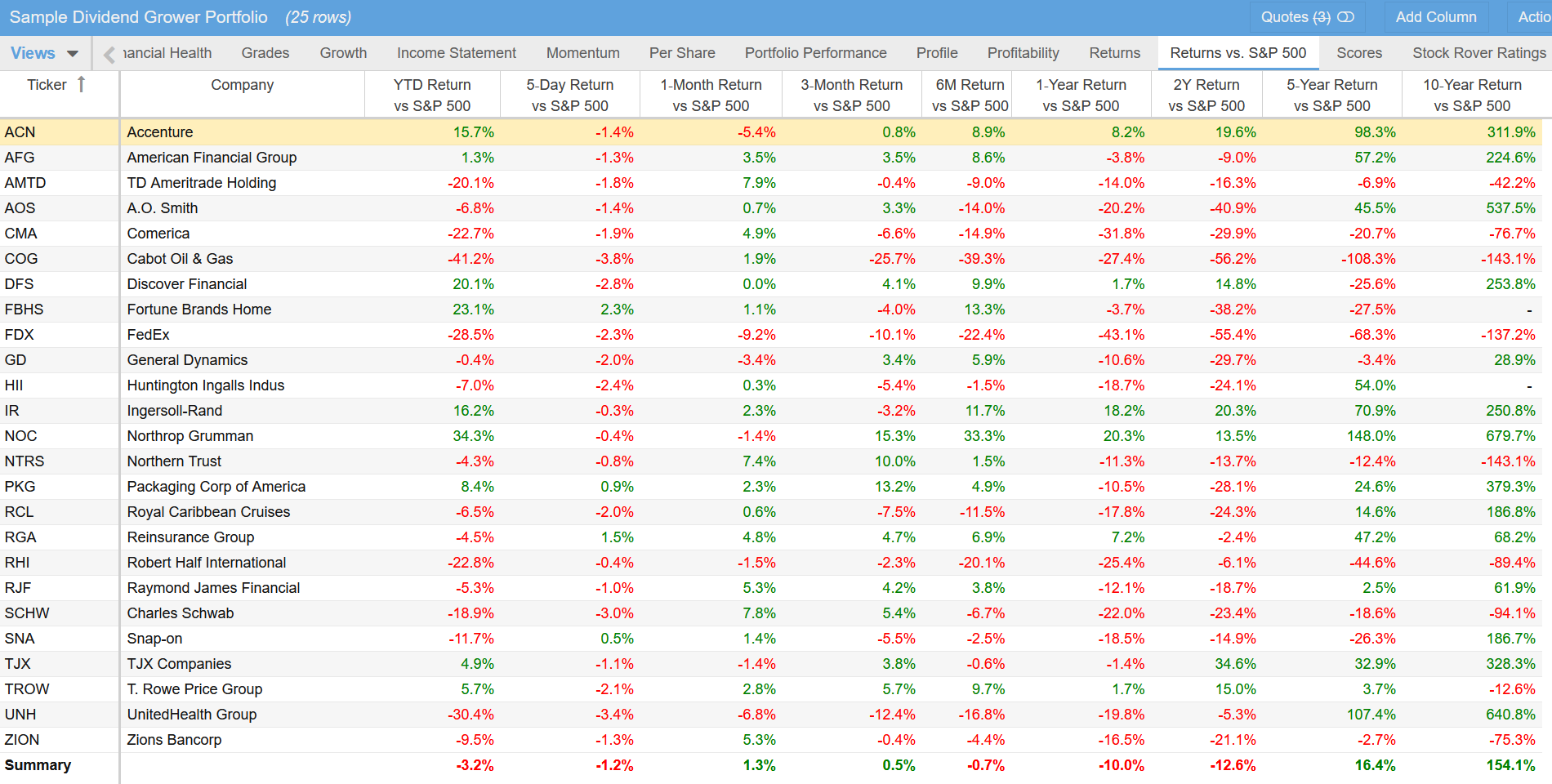

The Returns vs. S&P 500 View shows price performance of each ticker in table over key periods ranging from 5 days to 10 years relative to the S&P 500, dividend inclusive.

Financial Statements

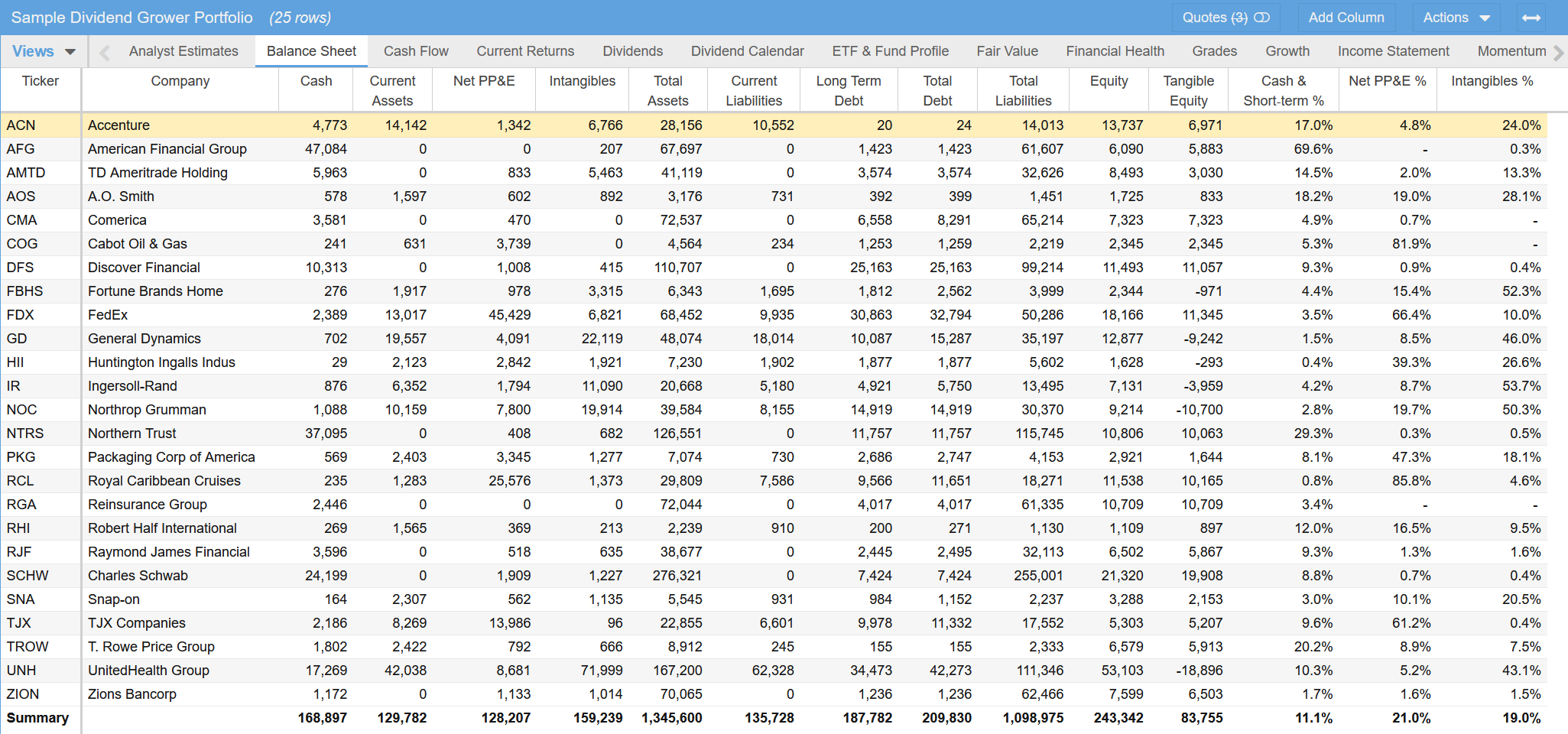

The Financial Statements Views have a view for each of the financial statement components, the Balance Sheet, Cash Flow Statement and Income Statement.

Each statement view puts key metrics from the statement into table format making it very easy to sort, filter and compare companies against each other. Below is an example of the Balance Sheet View.

Dividends

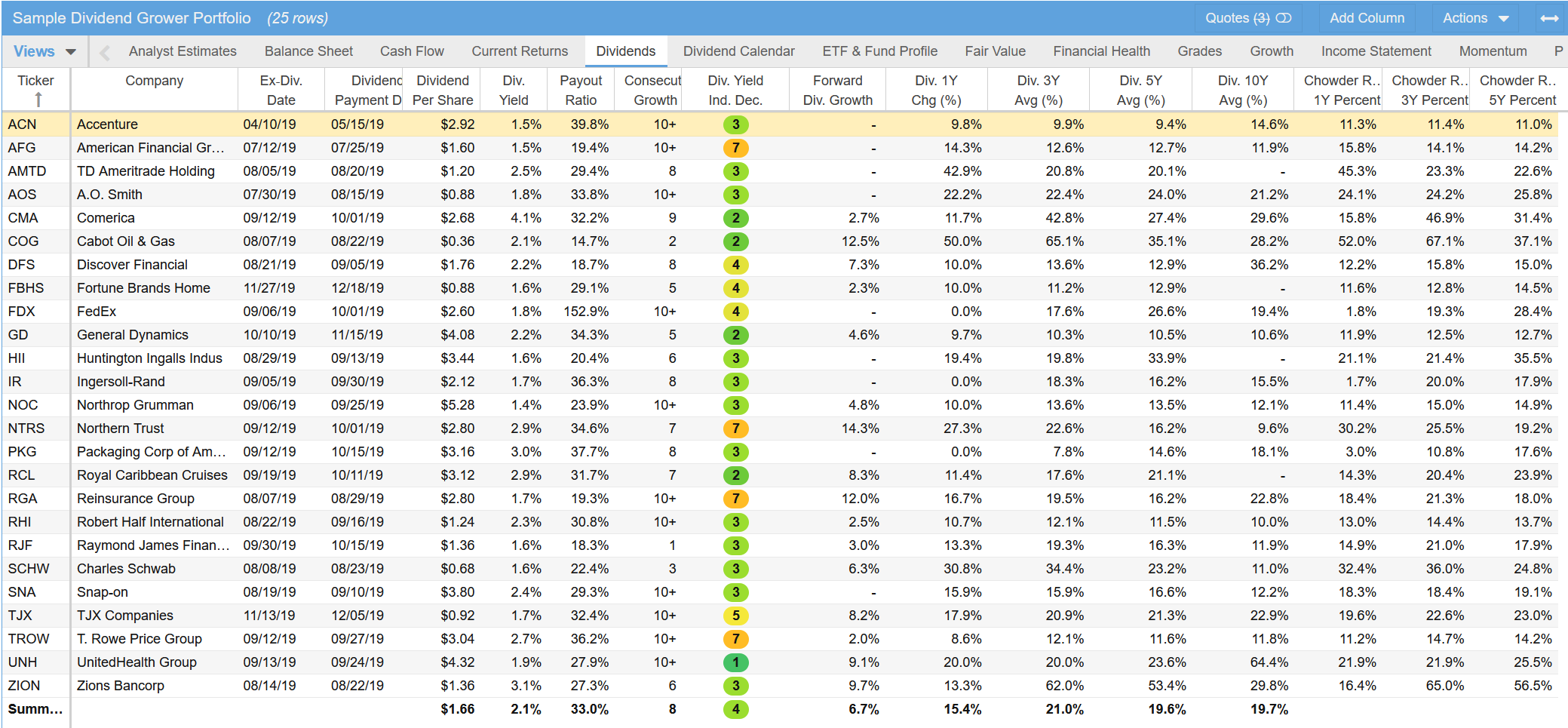

The Dividends Category has two Views.

The Dividends View provides extensive dividend information including dividends, yield, payout ratios, dividend growth over various periods and advanced statistics like the Chowder rule and number of consecutive years of dividend growth.

The Dividend Calendar View focuses on dividend payment dates and amounts. If a portfolio is selected in the table, the yearly divided payments and yield on cost are also shown.

Additional Metrics and Views

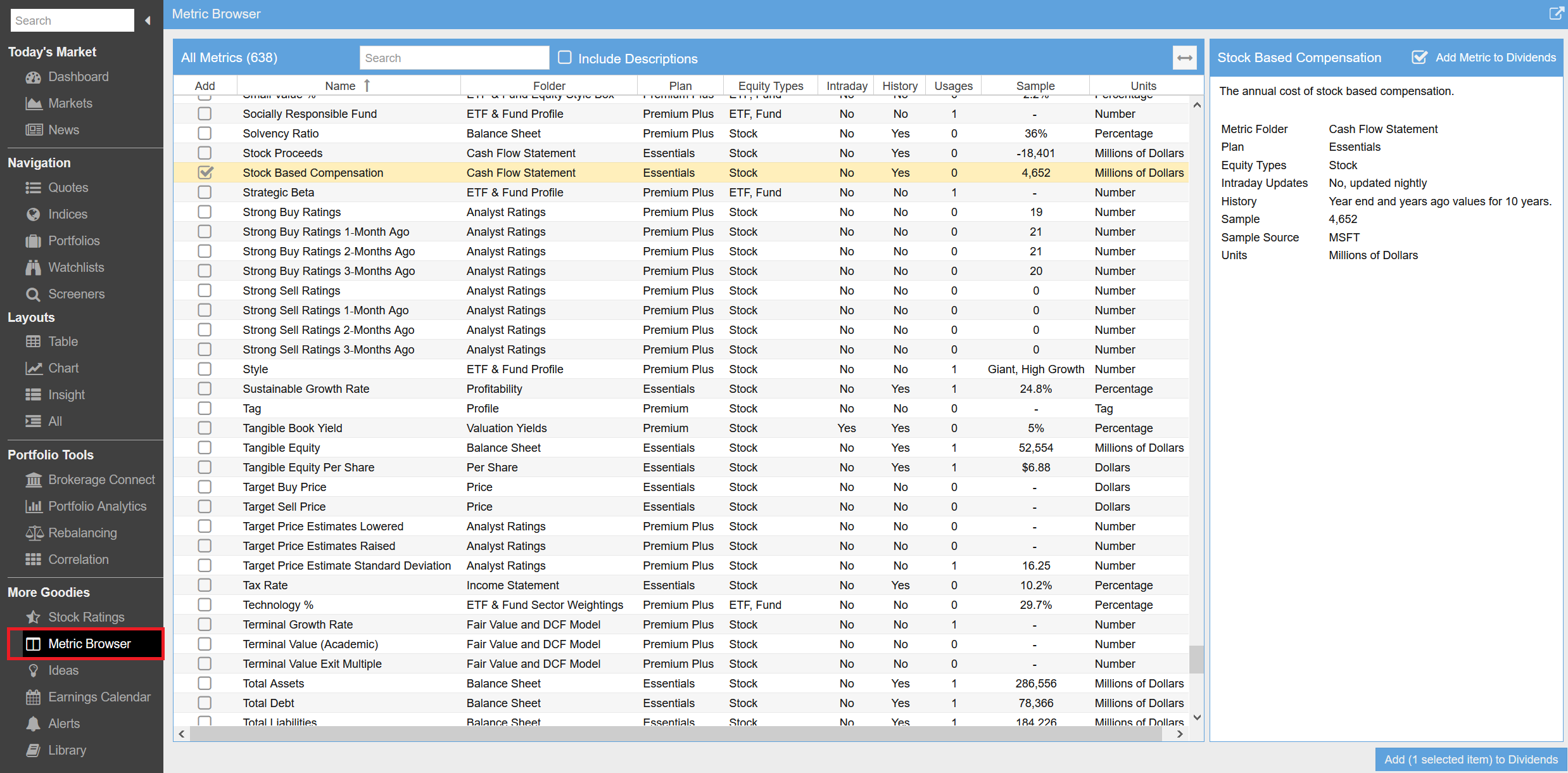

Finally as mentioned at the beginning of the blog, there are a whole host of metrics that can be added to existing views or grouped together in new Views. Stock Rover has over 600 metrics. They can easily be searched and viewed via the Stock Rover Metric Browser [28].

Believe it or not, the 22 provided out of the box view show only around half of the over 600 metrics available in Stock Rover. So there is a lot more to explore to help you in your investment research process.

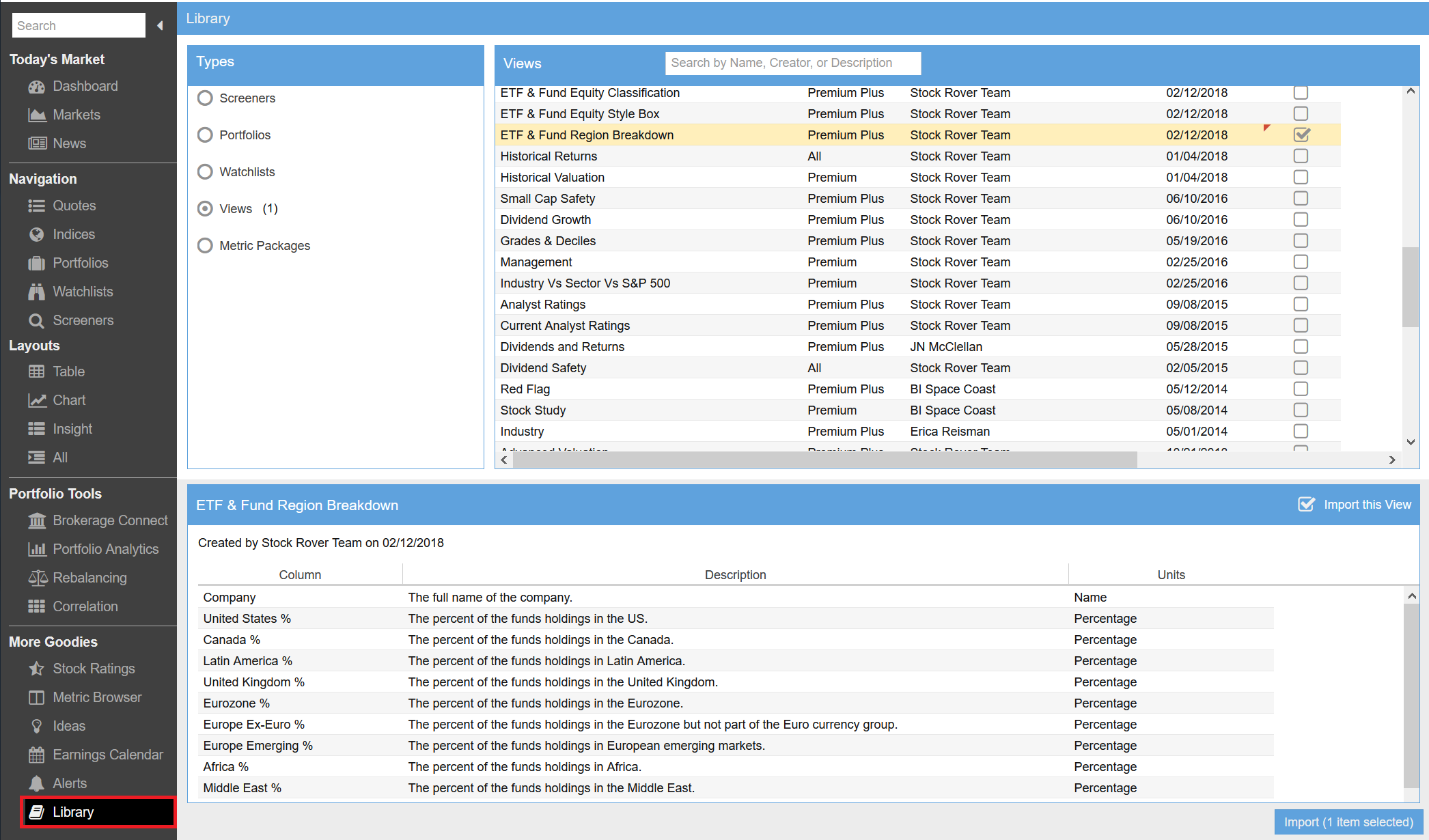

There are also a number of additional views in the Stock Rover Investor’s Library [30] including the CAN SLIM view, Analyst Revisions, Buy Target Prices and a number of additional Views specifically designed to provide more detailed information for ETFs and mutual funds.

I encourage you to explore the Views Stock Rover offers by just clicking on them and seeing what they offer. If you want to extend Stock Rover further, then a visit to the Metrics Browser and the Stock Rover Investor’s Library would be great next steps to get the full benefits from the considerable capabilities of Stock Rover.