Knowing when to sell is one of the most challenging aspects of investing. To improve your performance, you can analyze charts to understand when it would have made sense to sell a stock in the past. Of course, “hindsight is 20/20” while reading the current moment is never as clear, and it can be fraught with emotion.

In this article I want to explore why knowing when to sell can be so challenging, and provide practical tips for approaching the question. For more discussion and a live demonstration, watch my When to Sell [1] webinar from earlier this year.

Contents

- The Emotional [2]

- The Practical [3]

- Factors [4]

- Valuation [5]

- Technicals [6]

- More Factors [7]

- Summary [8]

The Emotional

Deciding when to exit I find to be the hardest thing to do as an investor. Why?

It is a much more emotional decision than buying. You have already made the decision to commit to this stock and have formed some sort of bond with it. So selling it is a bit like departing with a loyal friend.

If it has treated you well, you feel disloyal. And you feel if it has done well in the past, why can’t it continue to do well in the future? After all it has momentum on its side, which is Newton’s first law of motion. Also you will faces two other issues: generating a guaranteed tax bill and finding a better replacement (which means work on your part).

If it has treated you poorly, you may secretly feel that it is only a question of time before the market recognizes its virtues and you should wait it out. On the other hand, if you clearly see that things have really changed, or if you missed a key fact in your investment analysis (like the company has too much debt), you know in your heart it is time to go. But you feel loss. Selling will be the acknowledgment of the mistake, and is also the abandonment of hope. It makes you feel stupid—why didn’t I just set fire to my money?

In fact, the field of behavioral finance has demonstrated that the pain we derive from market losses impacts us twice as much as the pleasure we feel from market gains.

And there is the other big fear: you sell and the stock rallies right after. There is no worse feeling in investing. You are left behind while everyone else has a good time and you feel even stupider. I’ve been there, it doesn’t feel great.

So, the emotional component of ownership makes selling a much tougher decision than buying. The “endowment effect” is a well-observed phenomenon in which people tend to overvalue things they already own. For example, when people sell their houses, they invariably think their house is worth way more than the realtors do, who try to talk the client down to a realistic selling price. Unfortunately the same holds true for stock ownership.

The Practical

The best place to start is to ask yourself the following question and answer it honestly:

“If I didn’t own the stock, would I buy it today?”

If the answer is no, you should probably sell. One exception would be you have a huge gain and think the stock is not great, but is “okay.”

If you are really unsure, you can always sell a portion of your position to hedge your own judgment a bit.

Factors

Here are some factors that can help you decide if and when to sell.

Valuation

- Current P/E versus historical—if the stock is breaking into new P/E highs, it could be overextended.

- When the rise in the stock is solely due to P/E expansion (i.e. the price is inflating while earnings stay the same), you may want to reduce or get out. See below.

Technicals

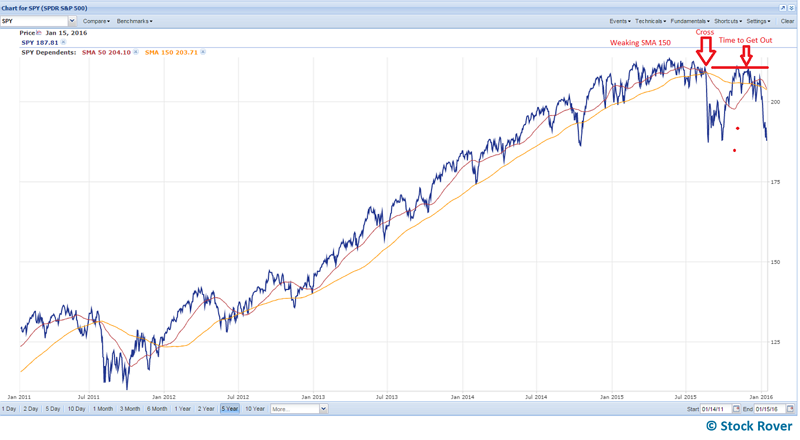

- When the simple moving average (SMA) changes that show the stock is losing momentum. See the weakening SMA 150 with a SMA 50 crossover below.

- Sector or industry rotation—the sector or industry is getting more “out of favor.” Such negative momentum is on display in the following two charts, both compared to the S&P 500 (in red and set as a baseline [11]).

- Chronic underperformance—it’s tough to make money when your stock is in a bad neighborhood:

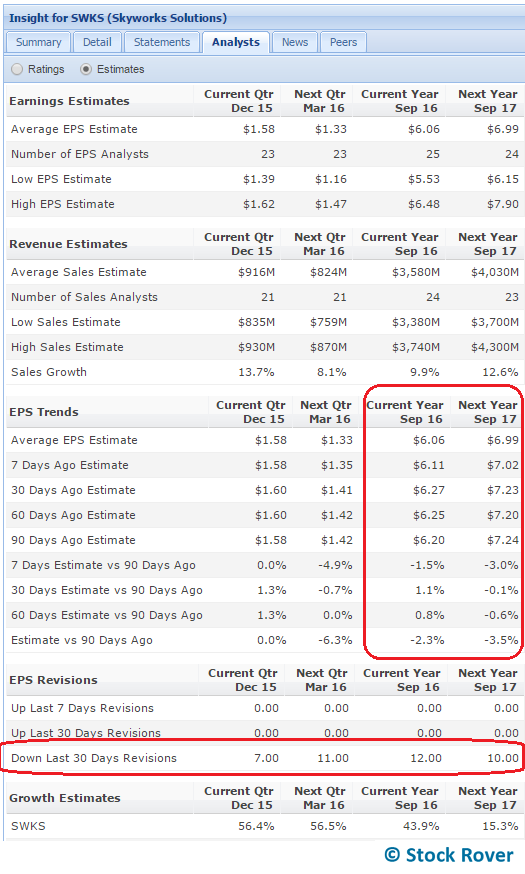

- Decreasing earnings estimates, which can be found under the Analysts tab of the Insight panel. The image below shows that the estimates have been revised downward a few times, so they are lower than they were 90 days ago.

- Extended chart (the price is way over its averages), as illustrated in the next two images. Notice the sale should come on the first jump. You may miss some more top, but in the long run you will be happier by avoiding big drops.

More Factors

A few more things to consider when deciding if to trade…

- In a down market, is your stock, industry and sector underperforming badly? If so, consider selling.

- Change in business outlook. The company’s profitability may be affected by things like…

- Decreasing demand for a core product

- Oversupply (for example, in the energy sector)

- Commodity prices

- Other macro factors (interest rates, currency exchange rate, Brexit, etc.)

- Negative news. Is the company getting bad press that is exacerbating real fears?

- Management changes. You liked the old team, do you like the new one?

- High hedge fund ownership—this can get ugly [17] if the hedge funds pull out.

Summary

You can practice some of these concepts by looking at different ticker charts to see when would have been a good time to get out in the past (try to remove the benefit of hindsight!). Charting in Stock Rover is pretty straightforward, and you can always reference our charting help [18] if you have questions about how to replicate something you saw in this article.

Remember that selling is not easy, for anyone. Just try to put on a rational hat, look at all this stuff covered in this article, and then ask yourself that critical question “If I didn’t own the stock, would I buy it now?”

If the answer is anything but yes, start re-thinking your position.

Comments Disabled To "How to Know When to Exit a Position"

#1 Comment By Dave Sullivan On April 1, 2017 @ 10:57 am

Howard

Usually I do not comment but in this case thanks for a great article. It is a solid reminder (which I often need) of what factors need to be looked at when evaluating an existing position.

#2 Comment By Howard Reisman On April 3, 2017 @ 11:07 am

Thank you Dave. I appreciate the positive feedback

Howard

#3 Comment By Babatunde Taiwo On April 1, 2017 @ 4:47 pm

You tried to make it simple, however, you only succeeded in making it more difficult with all the technical details introduced, that only confirmed your initial position that selling is perhaps the most difficult aspect of the trade. It was well appreciated.

#4 Comment By Howard Reisman On April 3, 2017 @ 11:09 am

Thank you for the feedback. Yes, when selling, there are a lot of factors to consider. There is really no getting around it.

Howard

#5 Comment By Karl Lacher On April 1, 2017 @ 11:24 pm

“Current P/E versus historical—if the stock is breaking into new P/E highs, it could be overextended.

When the rise in the stock is solely due to P/E expansion (i.e. the price is inflating while earnings stay the same), you may want to reduce or get out. See below.”

I am rather new to SR so I might be off base here. You write here about P/E trends. Where in SR can one find

P/E trends?

#6 Comment By Howard Reisman On April 3, 2017 @ 11:11 am

The best place for P/E trends is to use the chart. Select P/E from the fundamental pull down menu and look at the P/E over time. It is best to look over a long time period (i.e. years)

Howard

#7 Comment By Russ On April 3, 2017 @ 5:10 pm

Another good rule of thumb is to ask yourself if the money currently invested in a given stock could be better used elsewhere.

#8 Comment By Howard Reisman On April 4, 2017 @ 7:09 pm

Completely agree as long as the tax implications of the sale are factored into the decision.

#9 Comment By Hal On July 8, 2017 @ 10:10 am

Thanks for republishing this excellent article.

Is consistent with advice given to me long ago–assets are not for loving. Harder to implement than say.

#10 Comment By CHRISTOPHER BOWEN On July 8, 2017 @ 12:59 pm

Many thanks for putting all sell factors in one place, a great checklist. I bought CBI recently, a way out of favor stock at its low range, and it gained 20% in four days. It is slowly dropping, so I will sell if that trend continues. Admittedly it was a speculative buy based on historically low price and a personal bias in its favor given its heavy construction business. It has nothing to do with Chicago, being a Netherlands based company. I keep feeling it will resume upward trend, purely emotional, why my head says take the money and run. Selling IS hard.

#11 Comment By Yefim Revutsky On December 30, 2019 @ 8:28 pm

This is very useful article.

#12 Comment By Yefim Revutsky On December 30, 2019 @ 8:36 pm

Is ETF/STOCK RSI and/or Technical Strength and/or falling below 10 months (200 MA) be used?

Also when an equity 50 MA becomes below 200 MA it is also a reason to sell?

But I believe using P/E is very useful Idea. Thank you very much

#13 Comment By Howard Reisman On December 31, 2019 @ 8:29 am

Certainly those technicals are useful indicators as well. They all help tell the overall story for a stock.